Global markets this week signal caution amid elevated US Treasury yields around 4.17% and a weakening Indian rupee at 90.95 per USD, reflecting foreign outflows and policy uncertainties. For the Indian diaspora, from the US and UK to the Gulf, Africa, and beyond, these shifts directly impact remittances, investments, family finances, and career stability. Decoding them early provides a strategic edge over reacting to headlines.

Table of Contents

Equities: From Broad Rallies to Selective Strength

Global stocks have shifted from euphoria-driven gains to rewarding companies with proven earnings, pricing power, and strong balance sheets. In the US, the S&P 500 lingers near 6,914 as expectations for rapid Fed rate cuts fade, favoring large-cap tech, energy, and productivity-linked sectors under a “higher for longer” rate outlook.

European markets echo this caution, with export-heavy firms reacting to currency swings and softening global demand, while India’s Sensex, at around 84,181, grapples with $2.5 billion in foreign outflows this January amid broader emerging-market jitters.

For North American and European diaspora members with diversified portfolios, this environment prioritizes discipline: systematic investments and factor-based ETFs in quality stocks outperform broad index chasing. Asia-Pacific NRIs benefit from India’s structural tailwinds – like manufacturing incentives and digital infrastructure – but must focus on earnings quality amid Nifty volatility. Gulf professionals tied to energy see stability in related equities despite outflows.

US large-caps lead on cash generation and rate resilience.

- Indian markets dip short-term but hold long-term promise.

- Diaspora tip: Rebalance to 30-40% quality global equities.

Bonds: Elevated Yields, Steady Signals

Bond markets deliver the week’s clearest message: US 10-year yields at 4.165% (slightly up) indicate tamed inflation without aggressive easing ahead, with the Fed steady at 3.75% and just two cuts priced in for 2026. India’s 10-year yield holds at 6.63%, supported by the RBI’s vigilance, while UK gilts are at 4.41%.

This favors diaspora savers and retirees: US and UK fixed-income now competes with equities for NRI retirement portfolios, offering better yields than low-rate bank deposits. Elevated global rates raise home loan and business borrowing costs worldwide, prompting a reassessment of debt exposure. For many, shifting to 40-50% bonds restores portfolio balance amid equity choppiness.

| Bond Market | Current Yield | Diaspora Impact |

| US 10-Year | 4.165% | Strong NRI fixed returns |

| India 10-Year | 6.63% | Hedge rupee volatility |

| UK 10-Year | 4.41% | UK Indians diversify safely |

Currencies: Rupee Faces Headwinds

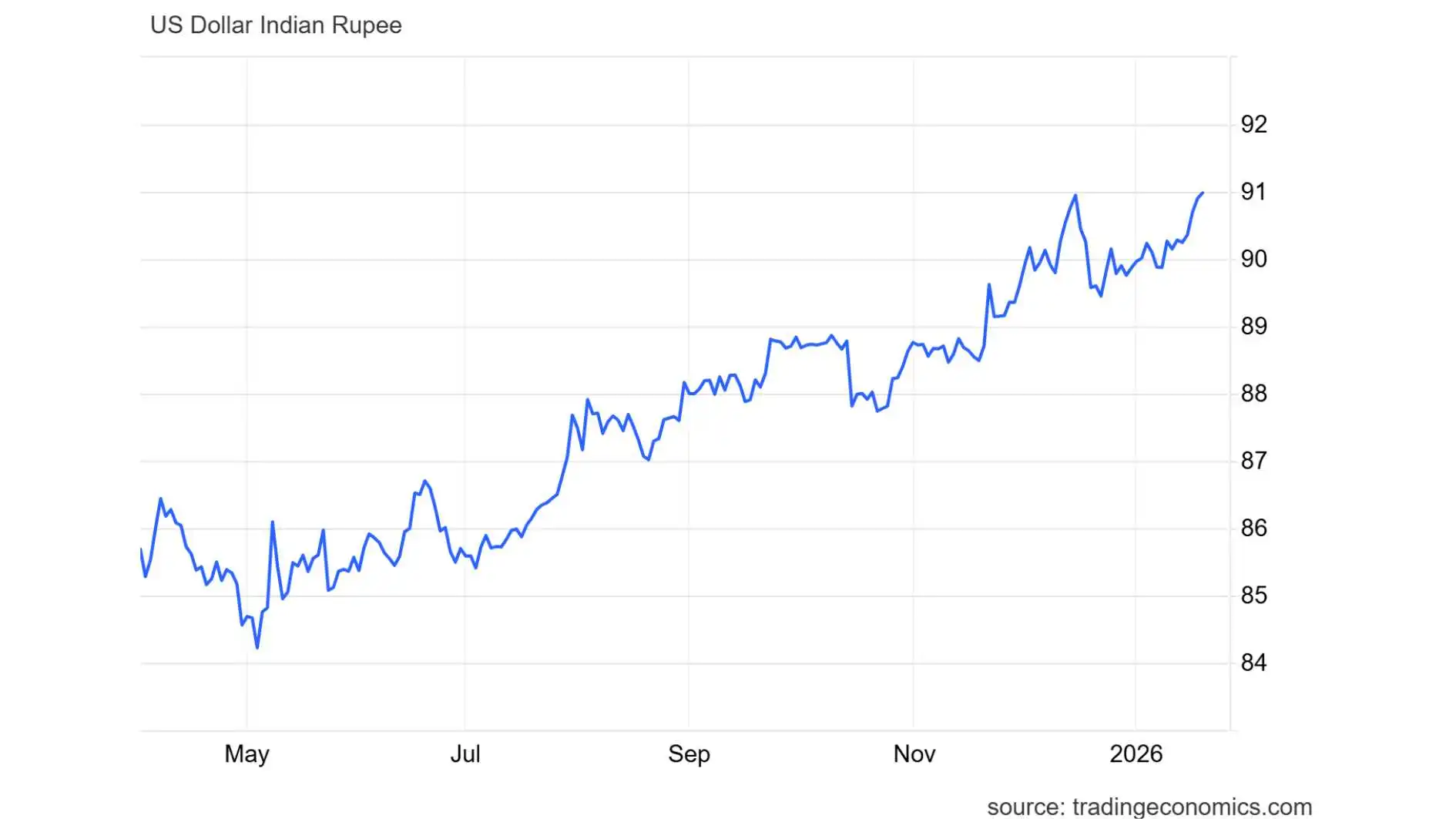

The Indian rupee has weakened in recent weeks amid sustained foreign portfolio outflows, importer-led dollar demand, and a firm US dollar environment. However, this movement reflects adjustment rather than instability. India’s substantial foreign-exchange reserves and the Reserve Bank of India’s active liquidity management continue to limit volatility, signalling tolerance for flexibility rather than defence of a fixed level.

The USD/INR reached 90.945 on January 19, up 0.28% daily and 1.5% monthly, pressured by equity outflows ($300-400M daily), importer demand for dollars, and US policy noise, such as tariff discussions. RBI forex reserves provide a buffer, but resilience is tested in this environment.

For the Indian diaspora, the implications are immediate and practical. Short-term remittances lose purchasing efficiency, overseas education and travel costs rise, and cross-border business transactions face tighter margins. At the same time, rupee softness improves the relative valuation of India-focused assets for long-term investors. In this environment, timing transfers, staggering remittances, and using simple currency-hedging tools are no longer optional; they are essential components of financial planning.

Remittances, a $2.5 billion monthly lifeline for Indian families, erode faster – a US earner loses roughly 5% annual purchasing power. African diaspora converting earnings for cross-border business face higher costs, while Gulf workers benefit from AED’s dollar peg and steady oil flows. Practical fix: Use hedging tools like forwards or apps like Wise to lock in rates.

- Track RBI interventions to smooth spikes.

- UK/Europe Indians: GBP/INR at 121.97 aids inflows.

- Long-term: Rupee stability supports India-focused savings.

Commodities: Stability Over Spikes

Crude oil at $56.93 per barrel includes geopolitical premiums without demand overheating, signaling modest global growth. Industrial metals reflect steady infrastructure and manufacturing, aligning with India’s capex drive, while gold at $4,427/oz hedges uncertainties.

The Middle East diaspora in the energy sector enjoys job security and bonuses from stable prices. African infrastructure players and Indian exporters avoid inflation whiplash, and global households see lower fuel costs for visits home. This tempers living expenses across borders.

- Energy pros: Stable prices = reliable incomes.

- Exporters: Modest metals aid competitiveness.

India’s Structural Edge

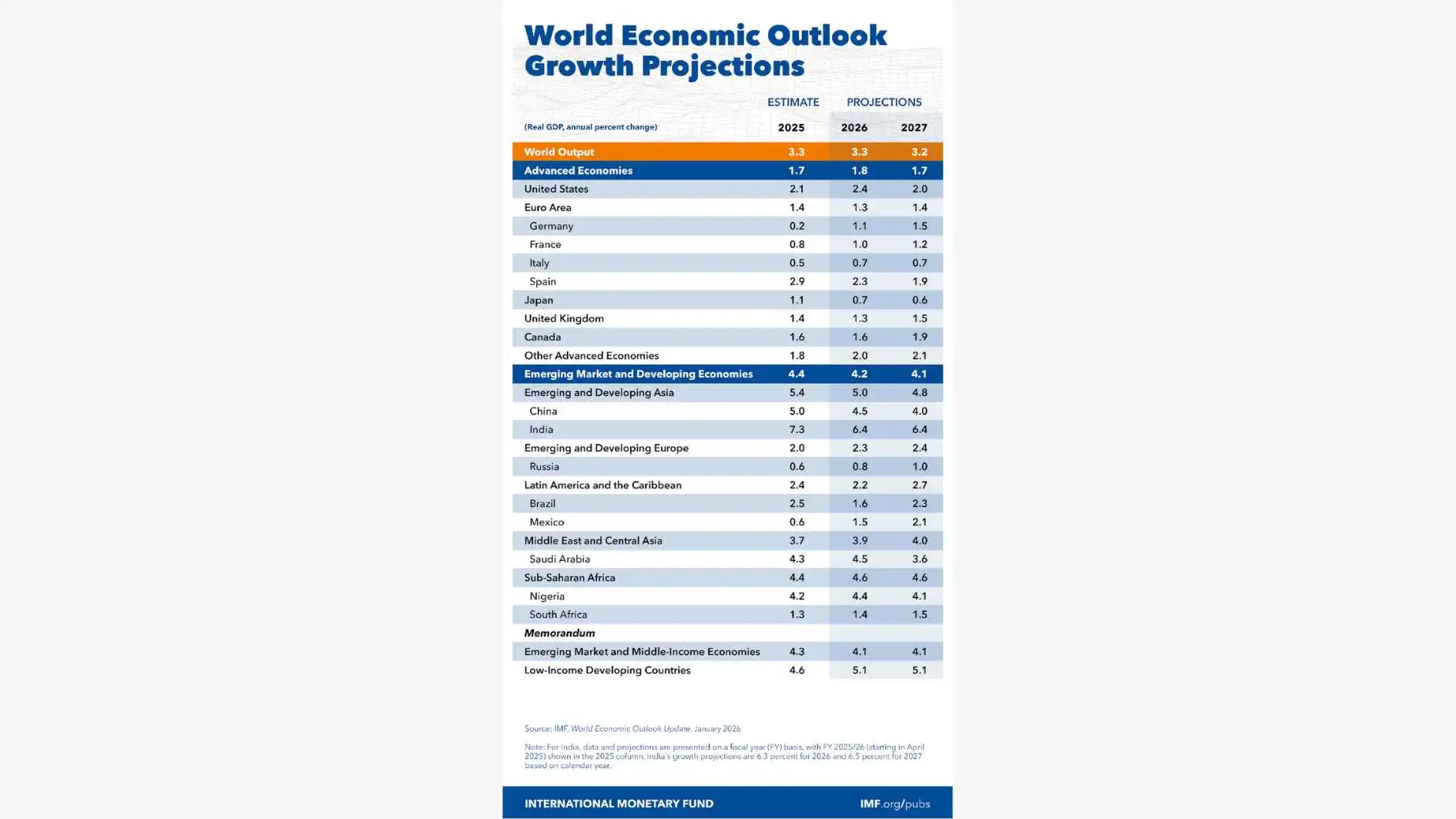

India stands out amid global recalibration: The IMF’s January 2026 update raised FY26 growth to 7.3% (from 6.6%), citing robust Q3/Q4 performance, though calendar 2026 moderates to 6.4%—still far above the global 3.3%. Domestic consumption, digital public infrastructure, and capital depth fuel this, but markets now emphasize governance and execution over projections.

For the diaspora, India remains an emotional and financial anchor: Selective bets in equities, startups, real estate, and private credit shine, especially as a weaker rupee enhances repatriation value in the long term. US NRIs and UK families can confidently lean into this growth differential.

The Counter-Narrative: What Could Change the Trajectory?

This will help the Indian diaspora understand that market stability is fragile.

Inflation Phoenix: Dormant inflation resurges, forcing Fed/ECB/RBI back into hikes. Diaspora impact: remittance power erodes if USD/INR > 92.

Policy Misstep: “Higher for longer” breaks consumers and corporates. Diaspora impact: job security abroad, defaults in Indian startups.

Geopolitical Black Swan: Strait of Hormuz/Taiwan Strait disruptions fracture supply chains. Diaspora impact: imported inflation, Gulf employment risk.

China Wildcard: Disorderly slowdown or rebound reshapes Asia flows. Diaspora impact: correlated EM sell‑offs or capital diversion from India.

Practical Implementation

Foresee risks and be prepared.

| Potential Risk | Impact on the Global Market | Impact on Indian Diaspora |

| Resurgent Inflation | Rates stay high; Tech stocks fall | Higher mortgage/loan costs abroad |

| Oil Price Spike ($100+) | Global transport costs rise | Rupee weakens; India’s trade deficit grows |

| Geopolitical Escalation | Flight to “Safe Havens” (Gold/USD) | Stock portfolio volatility; Remittance uncertainty |

Practical Action Steps

Arm yourself for this discerning market:

- Portfolio Review: Trim speculative holdings; boost quality equities and bonds.

- Remittance Hedge: Lock rates via multi-currency accounts amid USD/INR at 90.95.

- Regional Diversification: Aim 30% India assets, 40% US/Europe, 30% cash/debt.

- Key Watches: US payrolls this Friday, RBI policy cues, oil geopolitics.

- Long-Term Play: SIP into Nifty ETFs for India’s 7.3% FY26 upside.

Watchlist Indicators

To stay ahead of headlines, track these leading signals:

- US Core PCE & Wage Growth: >0.4% MoM = inflation red flag

- Brent Crude Futures: Sustained >$85/barrel = building inflationary pressure

- Global PMI New Orders Index: <48 = manufacturing recession deepening

- China Credit Impulse: Sudden loan growth spike = stimulus rollout

Markets now price maturity over panic, rewarding the globally connected Indian diaspora, investors, entrepreneurs, professionals, and families at the nexus of capital, culture, and growth. Navigate with clarity and patience for the win.

Final Takeaway

Markets signal maturity, not crisis, elevated yields, rupee pressures at 90.95, and selective equities reward discipline over speculation. For the Indian diaspora, this choppy global landscape underscores India’s IMF-boosted 7.3% FY26 growth as your structural anchor, powering remittances, investments, and family ties. Rebalance portfolios, hedge currencies, diversify regionally, and SIP into Nifty ETFs.

Stay informed on US payrolls and RBI moves. Your global position, bridging capital, culture, and opportunity, positions you to thrive with clarity and patience. Navigate smartly for lasting cross-border wins. Follow us at the Global Indian Network for updates.