“Your love is my good fortune.”

These words spoken by Prime Minister Narendra Modi resonate deeply with the spirit of the global Indian community – the Rashtradoots, or ambassadors of India – who spread culture, innovation, and prosperity worldwide.

Across seven seas and thousands of miles, no distance can dilute the profound connection global Indians share with their motherland. This vibrant overseas community, with its immense talent, entrepreneurial zeal, and enduring pride, holds the key to fueling India’s new century of growth and transformation.

As India strides forward as the world’s fastest-growing major economy, it is the collective energy of overseas Indians that will accelerate this journey – bridging borders, driving investments, seeding innovations, and enhancing soft power. Theirs is a story not just of geographical mobility but of a dynamic partnership, where every success abroad reverberates back home, shaping a future that’s bright, bold, and unequivocally Indian.

On a philosophical note, gratification comes when one knows the purpose of life. When one is operating on an international stage, the purpose has many facets. This piece delves into the lives of global Indians – their involvement and the underutilized potential.

Table of Contents

What Exactly is the “India Advantage”?

The India Advantage refers to the combination of India’s young workforce, digital infrastructure, expanding consumer base, and the world’s largest and most influential community, creating a unique global economic engine. It is the synergy between domestic strengths and overseas Indian capabilities that positions India for outsized long-term growth.

How Does India Differ From China, Vietnam, and Brazil?

Demographics

India remains young, while China, Vietnam, and even Brazil are aging. This gives India the largest long-term labor and innovation pipeline.

Digital Public Infrastructure

India’s DPI (UPI, Aadhaar, ONDC) is unmatched in scale and openness, enabling faster adoption of tech-driven services than most emerging economies.

Democratic + Market Hybrid

Unlike China’s state-driven model, India combines democracy with market-led innovation, appealing to global investors seeking stability and scale.

Global Indian Community Scale

India’s community is far larger and more globally distributed than Vietnam’s or Brazil’s and more economically influential across tech, health, finance, and academia than China’s has been in recent years.

The India Advantage: How Global Indians Can Fuel a New Century

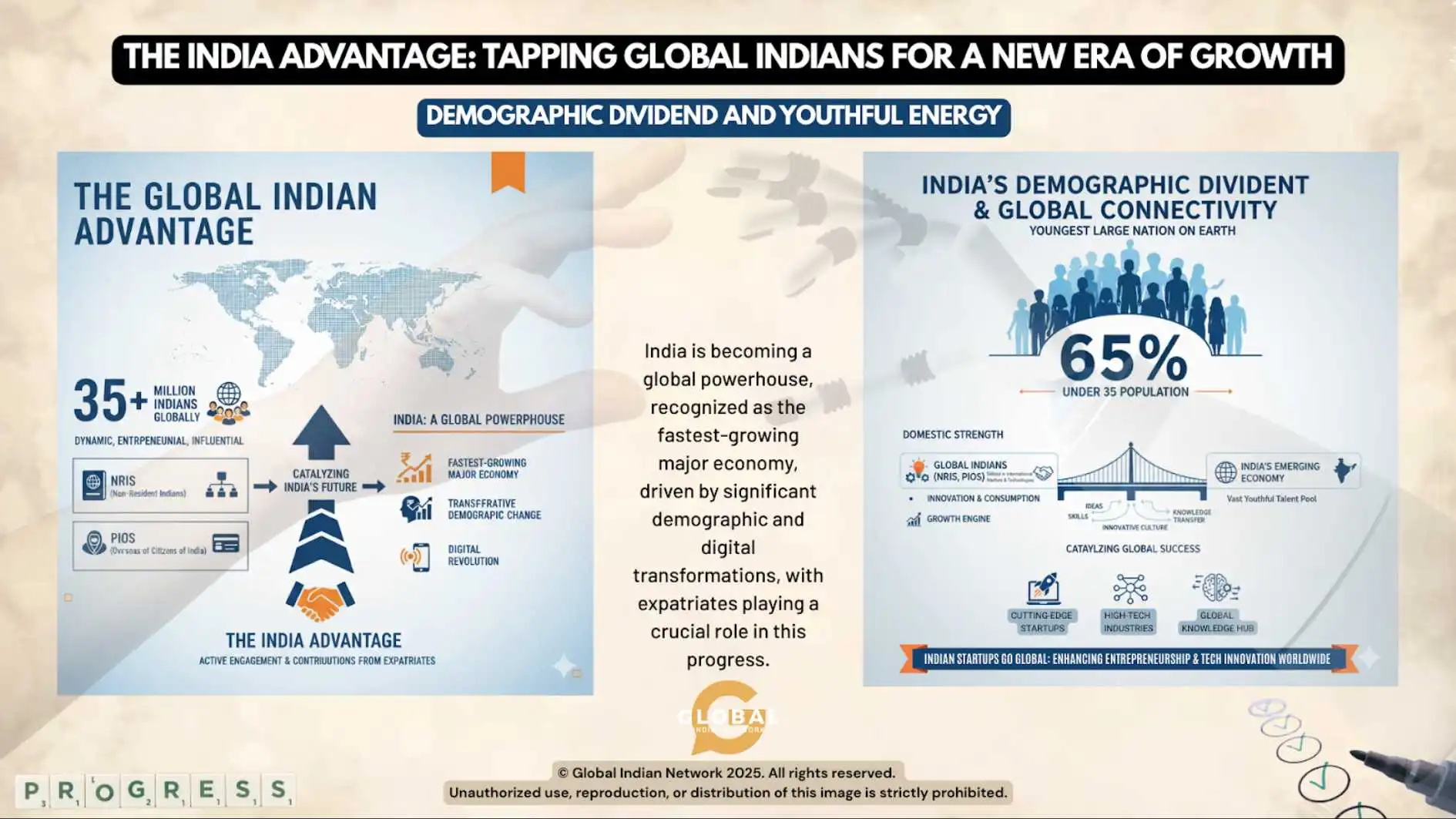

The global Indian migrant community, estimated at over 35 million, is among the most dynamic, entrepreneurial, and influential worldwide. This expansive network of Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs), and Overseas Citizens of India (OCIs) is uniquely positioned to catalyze India’s future economic, social, and technological trajectory.

As India emerges as a worldwide powerhouse – the fastest-growing major economy with transformative demographic and digital changes – the India Advantage comes alive through the active engagement and contributions of the expatriates.

Demographic Dividend and Youthful Energy

India’s defining strength in the 21st century is its demographic advantage. Over 65% of the population is under 35, making it the youngest large nation on Earth. This youthful workforce is not only a driver of domestic innovation and consumption but also a talent pool that global Indians can connect to foster cutting-edge startups, high-tech industries, and knowledge transfer.

The migrants, often skilled in international markets and technologies, serve as a bridge, facilitating the exchange of ideas, skills, and an innovative culture between international hubs and India’s emerging economy. Many Indian startups founded or funded by international members have scaled globally, enhancing India’s stature as a hub for entrepreneurship and technological innovation.

Remittances and Economic Impact

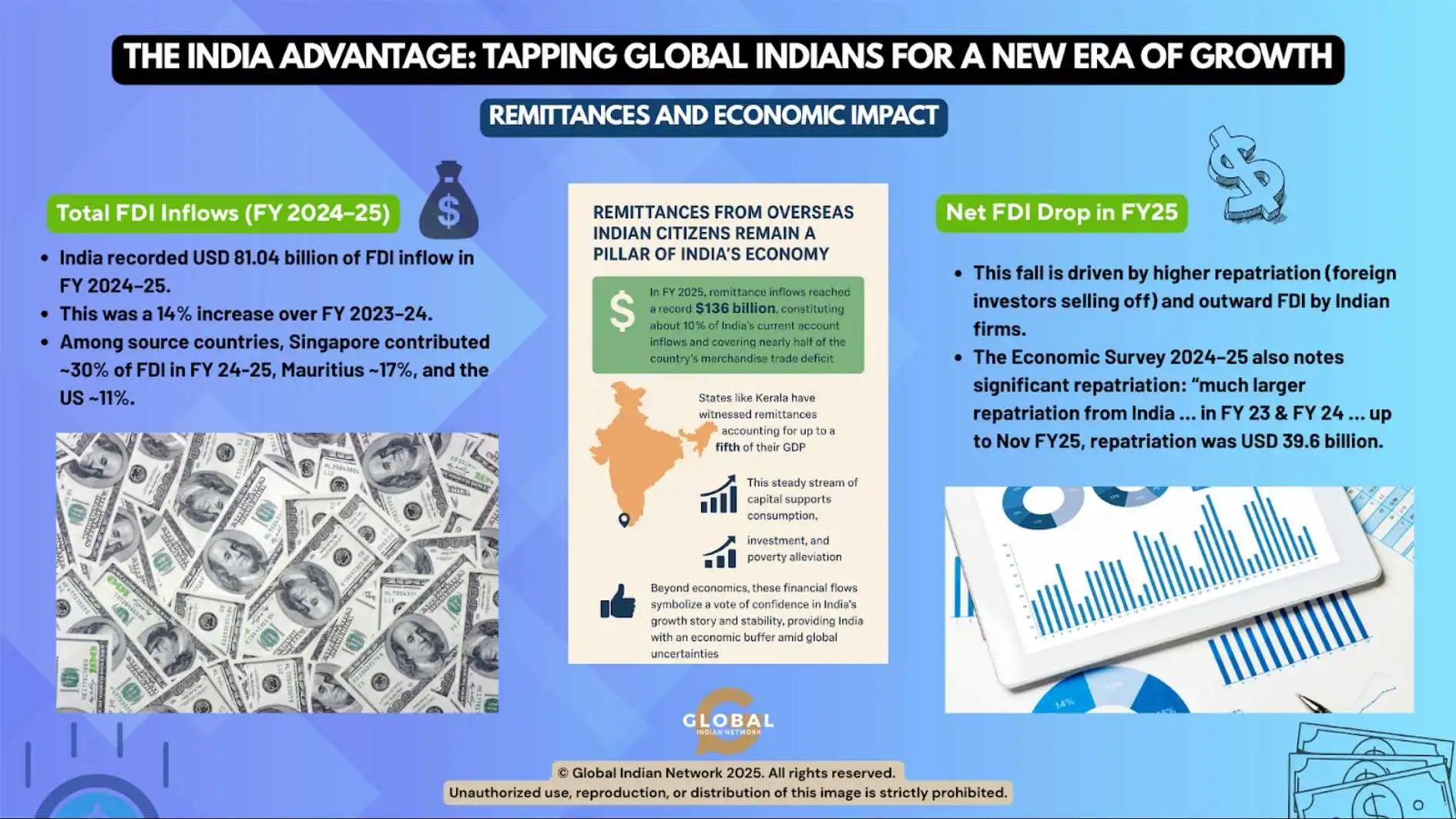

Remittances from the overseas Indian citizens remain a pillar of India’s economy. In FY 2025, remittance inflows reached a record $136 billion, constituting about 10% of India’s current account inflows and covering nearly half of the country’s merchandise trade deficit.

States like Kerala have witnessed remittances accounting for up to a fifth of their GDP. This steady stream of capital supports consumption, investment, and poverty alleviation. Beyond economics, these financial flows symbolize a vote of confidence in India’s growth story and stability, providing India with an economic buffer amid global uncertainties.

Total FDI Inflows (FY 2024–25)

- India recorded USD 81.04 billion of FDI inflow in FY 2024–25.

- This was a 14% increase over FY 2023–24.

- Among source countries, Singapore contributed ~30% of FDI in FY 24-25, Mauritius ~17%, and the US ~11%.

These countries are relevant because a significant portion of FDI from them could be from overseas investors (NRIs/OCIs) or investment vehicles linked to expatriates, though not all of it is necessarily from the community.

Net FDI Drop in FY25

Despite strong gross inflows, net FDI (inflows minus repatriation/outflows) dropped sharply. Business Standard reports net FDI of just USD 1.5 billion (Apr 2024 – Feb 2025), down from earlier, much higher levels.

- This fall is driven by higher repatriation (foreign investors selling off) and outward FDI by Indian firms.

- The Economic Survey 2024–25 also notes significant repatriation: “much larger repatriation from India … in FY 23 & FY 24 … up to Nov FY25, repatriation was USD 39.6 billion.”

Investment, Entrepreneurship, and Knowledge Transfer

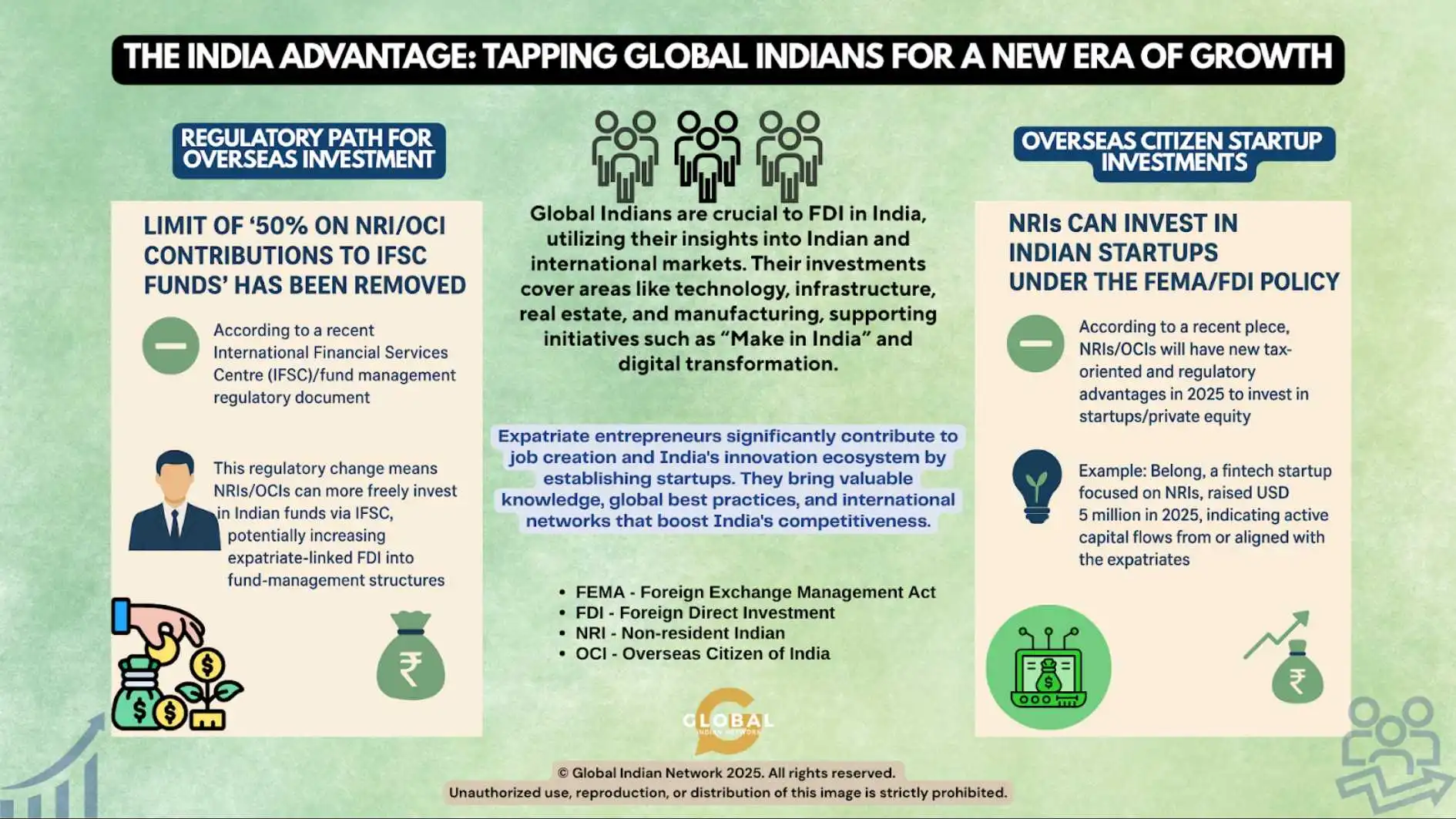

Global Indians play an indispensable role in Foreign Direct Investment (FDI) into India, leveraging their deep understanding of both Indian and international markets. Their investments span sectors such as technology, infrastructure, real estate, and manufacturing, reinforcing national priorities like “Make in India” and digital transformation.

Regulatory Path for Overseas Investment

- According to a recent International Financial Services Centre (IFSC)/fund management regulatory document, the limit of “50% on NRI/OCI contributions to IFSC funds” has been removed (with safeguards) as per the 2025 regulations.

- This regulatory change means NRIs/OCIs can more freely invest in Indian funds via IFSC, potentially increasing expatriate-linked FDI into fund-management structures.

Overseas Citizen Startup Investments

- According to NRIHelpline, NRIs can invest in Indian startups (equity, AIFs, VCs) under the Foreign Exchange Management Act (FEMA)/FDI policy, enabling a portion of transnational capital to flow into early-stage, high-growth companies.

- According to a recent piece, NRIs/OCIs will have new tax-oriented and regulatory advantages in 2025 to invest in startups/private equity.

- Example: Belong, a fintech startup focused on NRIs, raised USD 5 million in 2025, indicating active capital flows from or aligned with the expatriates.

Expatriate entrepreneurs play a crucial role in job creation and the development of India’s innovation ecosystem by founding startups and ventures. They return with valuable knowledge, global best practices, and international networks that enhance India’s competitiveness. Moreover, Indian-origin venture capitalists, angel investors, and family offices based in Silicon Valley, London, Singapore, and Dubai actively reinvest their knowledge, networks, and capital back into India.

Strategic Role in India’s Digital Leap

India’s digital revolution marks another frontier of the India Advantage with participation from the global Indian citizens. With over 920 million smartphone subscribers and billions of digital transactions annually, India is among the top global economies for digital consumption. The overseas citizens’ engagement in technology sectors, digital finance, and innovation ecosystems magnifies this transformation.

Many transnational Indians contribute through knowledge sharing, investments in tech startups, and partnerships that accelerate India’s leap into advanced technologies like IoT, AI, and fintech.

Soft Power and Bilateral Ties

The Indian collective amplifies India’s soft power by fostering trade, cultural exchange, and global cooperation. Their leadership in politics, academia, business, and the arts attracts investment and strengthens India’s voice internationally. Prominent Indian-origin CEOs at firms like Google and Microsoft further enhance India’s image. Unlike many communities, overseas Indians maintain strong ties, channeling sentiment into remittances, FDI, philanthropy, and entrepreneurship.

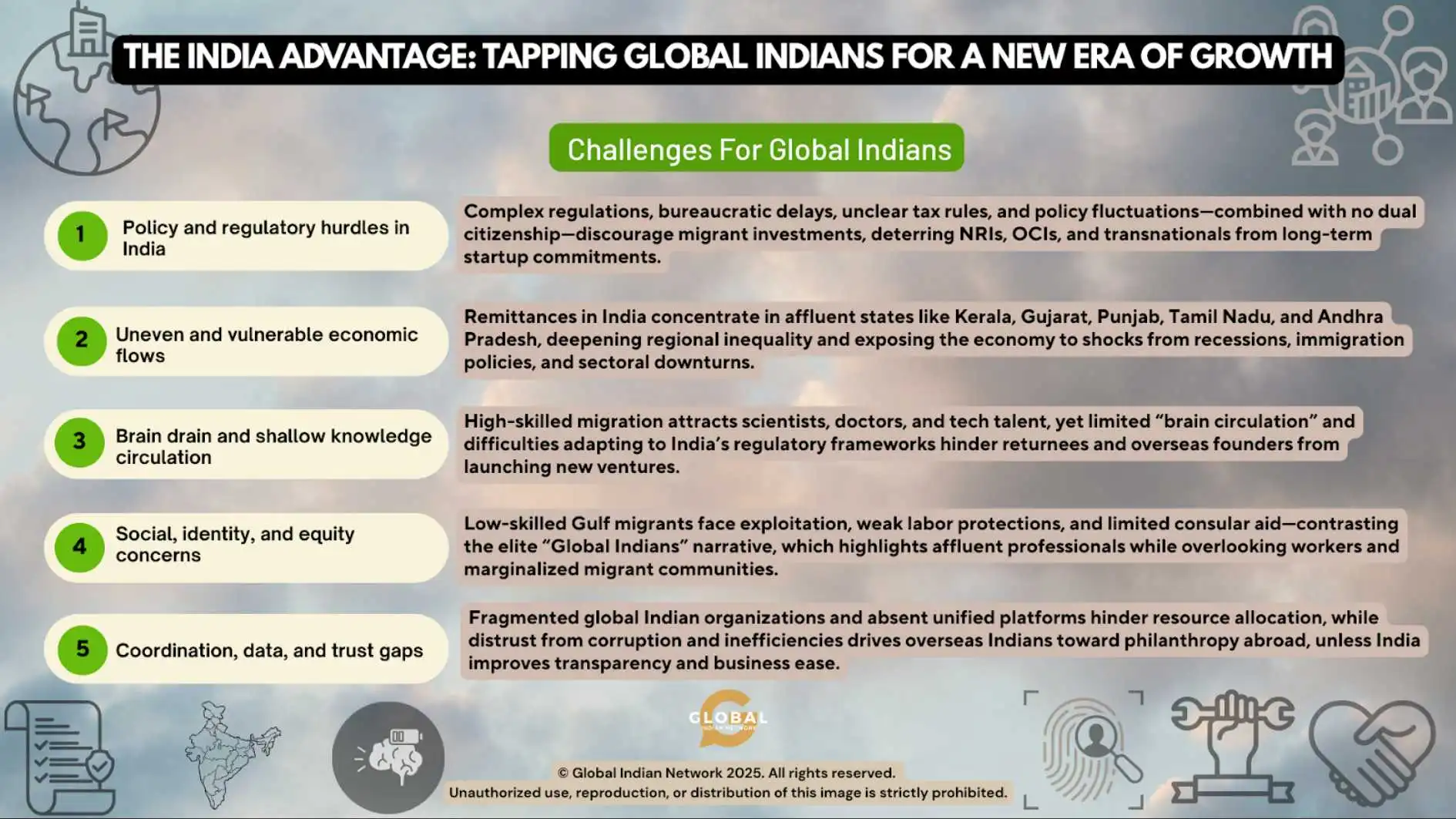

Challenges

Global Indians are a powerful asset to India’s growth story, but unlocking the full “India Advantage” comes with distinct challenges that your article can highlight. These challenges sit at three levels: within India, within host countries, and within the overseas community itself.

Policy and regulatory hurdles in India

Complex regulations and bureaucratic delays limit migrants‘ investment and the development of startups. Issues such as lack of dual citizenship, ambiguous tax rules, and frequent policy changes contribute to uncertainty, hindering long-term commitments from Non-Resident Indians (NRIs), Overseas Citizens of India (OCIs), and transnationals.

Uneven and vulnerable economic flows

Remittances in India are primarily concentrated in high-income regions such as Kerala, Gujarat, Punjab, Tamil Nadu, and Andhra Pradesh, exacerbating regional disparities and neglecting other areas. Furthermore, heavy reliance on remittances and Non-Resident Indian (NRI) deposits makes India vulnerable to economic shocks from host-country recessions, immigration policies, or downturns in sectors such as IT services and Gulf construction.

Brain drain and shallow knowledge circulation

High-skilled migration is attracting scientists, doctors, and tech talent, while established pathways for “brain circulation” are still limited. Returnees and overseas founders often struggle to adapt to India’s business culture and regulatory practices, hindering the launch of potential ventures.

Social, identity, and equity concerns

Low-skilled migrant workers in the Gulf face exploitation and inadequate labor protections, alongside minimal consular support, contrasting sharply with the narrative surrounding elite “Global Indians.” This selective engagement highlights wealthy professionals while sidelining workers and newer migrant communities, fostering an exclusive notion of who qualifies as a Global Indian.

Coordination, data, and trust gaps

Fragmented global Indian organizations and a lack of unified platforms hinder the effective channeling of resources for coherent national or state-level missions in India. Additionally, distrust stemming from past issues of corruption and bureaucratic inefficiencies leads many overseas Indians to prefer philanthropy and investment in other regions unless India can demonstrate transparency and improve the ease of doing business.

Case Examples

Several exemplary individuals from the global Indian diaspora highlight how this community fuels India’s growth and innovation.

Satya Nadella: CEO of Microsoft, exemplifies the global Indian presence in tech innovation and partnerships that advance India’s digital ecosystem.

Narayana Murthy: Infosys co-founder, who pioneered India’s IT services sector and inspired diaspora-led entrepreneurship and philanthropy.

Indra Nooyi: Former PepsiCo CEO, known for global business leadership with a focus on sustainability, aligning with India’s economic priorities.

Dr. Raghuram Rajan: Ex-RBI Governor and economist, emphasizing reforms critical to leveraging diaspora investments.

Dr. Devi Shetty: Cardiac surgeon and founder of Narayana Health, showcasing diaspora contributions to affordable healthcare and social entrepreneurship.

Sachin & Binny Bansal (Flipkart): From a garage startup to a $16B sale, they pioneered e-commerce in India and continue investing actively.

Bhavish Aggarwal (Ola Cabs): Disrupted Indian mobility and now leads India’s EV revolution.

Ritesh Agarwal (Oyo Rooms): Scaled the hospitality sector with innovative budget accommodation globally.

Nandan Reddy, Rahul Jaimini & Sriharsha Majety (Swiggy): Spearheaded popular food delivery services promoting tech-enabled convenience.

Vijay Shekhar Sharma (Paytm): Digital payments pioneer driving India’s fintech revolution.

Girish Mathrubootham (Freshworks): Built a global SaaS company from India, symbolizing scale-up success.

Varun & Ghazal Alagh (Mama Earth): Champions of clean, D2C personal care products.

These examples demonstrate the diaspora’s multifaceted role in transforming India’s economy—from technology and finance to healthcare and digital consumer markets, highlighting how global Indians create bridges of opportunity and innovation.

The Path Forward: Mobilizing the Global Indian Community

The India Advantage in the coming century hinges on deeper engagement with the global Indian citizens. Policies that facilitate international investments, simplify business operations, and encourage return entrepreneurship can harness their full potential. Collaborative platforms that enable scientific exchange, innovation partnerships, and expat-led philanthropy will stimulate inclusive growth. Encouraging migrant youth to connect with India’s burgeoning tech and startup ecosystems can generate new waves of innovation and cross-cultural collaboration.

India has the numbers, talent, and sentiment on its side – but only by tackling these structural challenges can it convert diaspora pride into sustained, strategic nation-building.

Policy Recommendations

Two tiers of recommendations are mentioned here, considering the complex nature of the Indian political and socio-cultural paradigm.

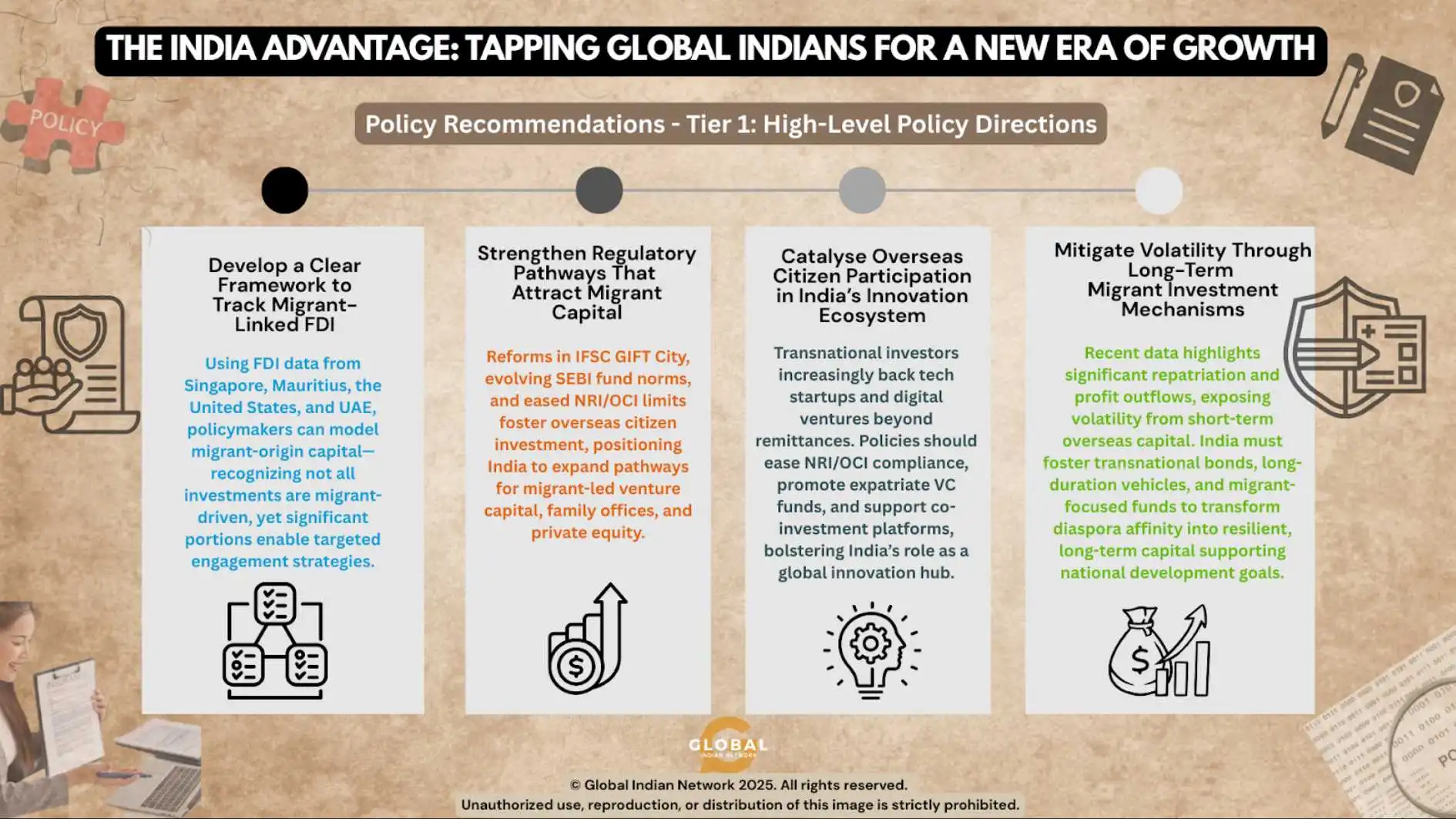

Tier 1: High-Level Policy Directions

Develop a Clear Framework to Track Migrant-Linked FDI

Leverage FDI source-country data – particularly flows from Singapore, Mauritius, the United States, and the UAE – to build approximation models for migrant-origin capital. While not all investments from these hubs are migrant-driven, a significant share likely is, and recognizing this helps policymakers design more targeted engagement strategies.

Strengthen Regulatory Pathways That Attract Migrant Capital

Recent reforms in IFSC GIFT City, SEBI’s evolving norms for fund management, and relaxed limits for NRI/OCI contributions have created strong enabling conditions for overseas citizen investment. These pathways should be expanded and deepened, positioning India as a competitive global destination for migrant-managed venture capital, family offices, and private equity vehicles.

Catalyse Overseas Citizen Participation in India’s Innovation Ecosystem

Transnational investors are increasingly active in tech startups, digital ventures, and early-stage innovation, moving far beyond traditional remittance channels. Policy must build on this trend by:

- simplifying cross-border investment compliance for NRIs/OCIs

- encouraging expatriate-run VC funds

- supporting co-investment platforms linking global Indians with Indian founders

This strengthens India’s position as a global innovation hub.

Mitigate Volatility Through Long-Term Migrant Investment Mechanisms

Recent data shows high levels of repatriation and profit outflows, signaling potential volatility if India relies too heavily on short-term overseas capital. To ensure resilience, India should promote:

- transnational bonds

- long-duration investment vehicles

- tax-efficient long-term funds

- migrant-targeted sovereign or infrastructure funds

These instruments convert the expat’s emotional affinity into stable, long-horizon capital aligned with national development goals.

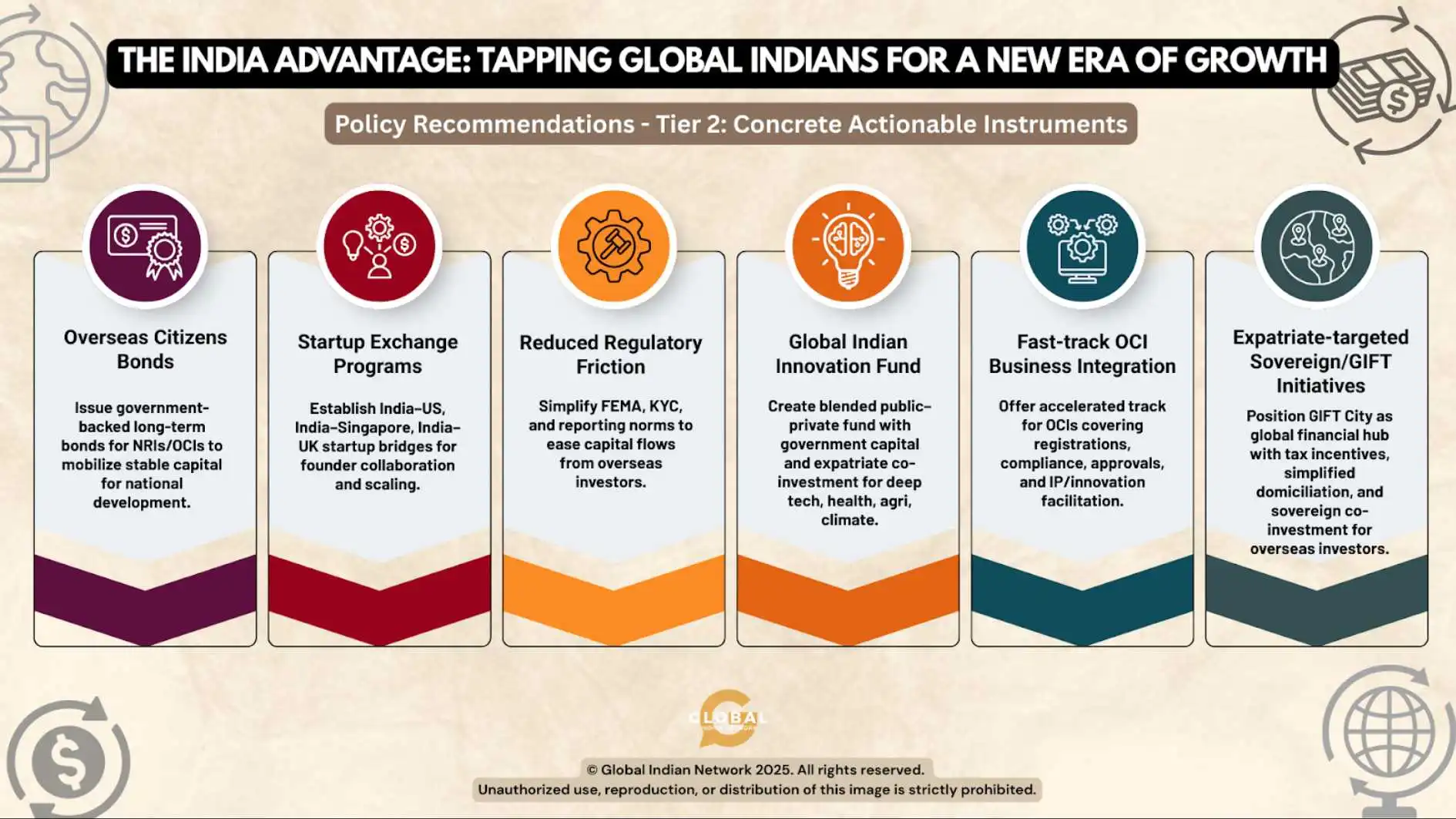

Tier 2: Concrete Actionable Instruments

- Overseas Citizens bonds: Issue government-backed long-term bonds specifically targeted at NRIs/OCIs to attract stable capital for infrastructure, climate, and national development projects

- Startup exchange programs: Create bilateral “startup bridge” (India–US, India–Singapore, India–UK) that enable Indian and transnational founders to collaborate, incubate, and scale together.

- Reduced regulatory friction: Simplify FEMA compliance, KYC requirements, and reporting norms for overseas VCs, angel investors, and family offices to facilitate smoother capital flows.

- Global Indian Innovation Fund: Establish a blended public–private fund anchored by government capital and co-invested by expatriate family offices, focused on deep tech, health-tech, agritech, and climate innovation.

- Fast-track OCI business integration: Provide an accelerated track for OCIs:

- business registrations

- compliance clearance

- investment approvals

- IP/innovation facilitation

- Expatriate-targeted sovereign/GIFT initiatives: Use GIFT City as a global financial magnet by offering:

- tax incentives for migrant-managed funds,

- simplified fund domiciliation rules,

- sovereign co-investment vehicles tailored for overseas investors.

Conclusion

The global Indian community is the primary engine fueling India’s ascent as a worldwide economic and intellectual powerhouse. India’s greatest strength is not confined within its borders; it pulses through boardrooms, laboratories, and innovation hubs across the world.

The Indian collective, woven into the fabric of every major global economy, is a living extension of India’s ambition. Their combined remittances, investments, entrepreneurial spirit, and cultural diplomacy converge to shape a new century of growth. This symbiotic relationship, where Global Indians are essential architects of India’s future prosperity, is a defining story of the 21st century.

Their ideas, capital, and influence form a powerful, outward-looking orbit, constantly pulling new global opportunities into the nation’s gravitational field. By nurturing this connection with clarity and vision, the ‘India Advantage’ can evolve from a demographic promise into a global phenomenon – a worldwide community rising together, interconnected, and unmistakably Indian.

At the Global Indian Network, our vision is to build an interconnected platform where Global Indians amplify their impact through collaboration, advancing India’s rise as an economic and intellectual giant of the 21st century.

Please join us on this proud mission. Share this piece to start with.