Insights from Ken Muturi, Co-Chief Investment Officer at Henriot Capital LLC, highlight how technology is reshaping both opportunity and deception in investment.

What happens when powerful technology outpaces everyday financial wisdom?

In East Africa’s fast-changing investment scene, artificial intelligence promises sharper insights, but it can just as easily fuel devastating mistakes. As wealth rises and scams grow more cunning, investor judgment becomes the ultimate safeguard. Drawing lessons from Kenya’s mobile money revolution and the perspective of investor Ken Muturi, Co-Chief Investment Officer at Henriot Capital LLC, this article reveals how AI could be the key to building lasting wealth, or the trap that destroys it.

AI, Ponzi Schemes, and Smarter Investing in a Rapidly Changing Africa

Artificial intelligence is reshaping investment research much like mobile money reshaped payments in East Africa. When M-Pesa launched in Kenya in 2007, it collapsed friction in financial transactions, enabling millions to move money instantly without bank branches. Today, AI promises a similar leap in investing by processing vast datasets at speed and scale. But as Kenyan investor and fund manager Ken Muturi warns, technology alone does not eliminate risk; it can just as easily accelerate it.

“The biggest challenge in Africa,” Muturi explains, “is the informational gap.” Investment knowledge remains uneven, often driven by hearsay rather than research. This gap, combined with rising wealth and optimism, has made the region fertile ground for Ponzi schemes and financial scams. If AI is misused or poorly understood, it risks creating bigger problems rather than fixing them.

Speed Without Judgment Is Dangerous

East Africa’s mobile money story offers a useful parallel. M-Pesa succeeded not simply because it was fast, but because it eventually built trust through regulation, consumer education, and fraud controls. In its early years, scams and social engineering flourished alongside easy adoption. Innovation widened access, but without safeguards, abuse followed.

Investing today sits at a similar crossroads. AI-driven platforms now offer sophisticated analytics once reserved for elite institutions. Retail investors can access market signals, sentiment analysis, and macro data at low cost. But speed does not replace understanding.

Machines will always try to make things perfect, but at the end of the day, the stock market is a representation of human psychology.”

– Ken Muturi

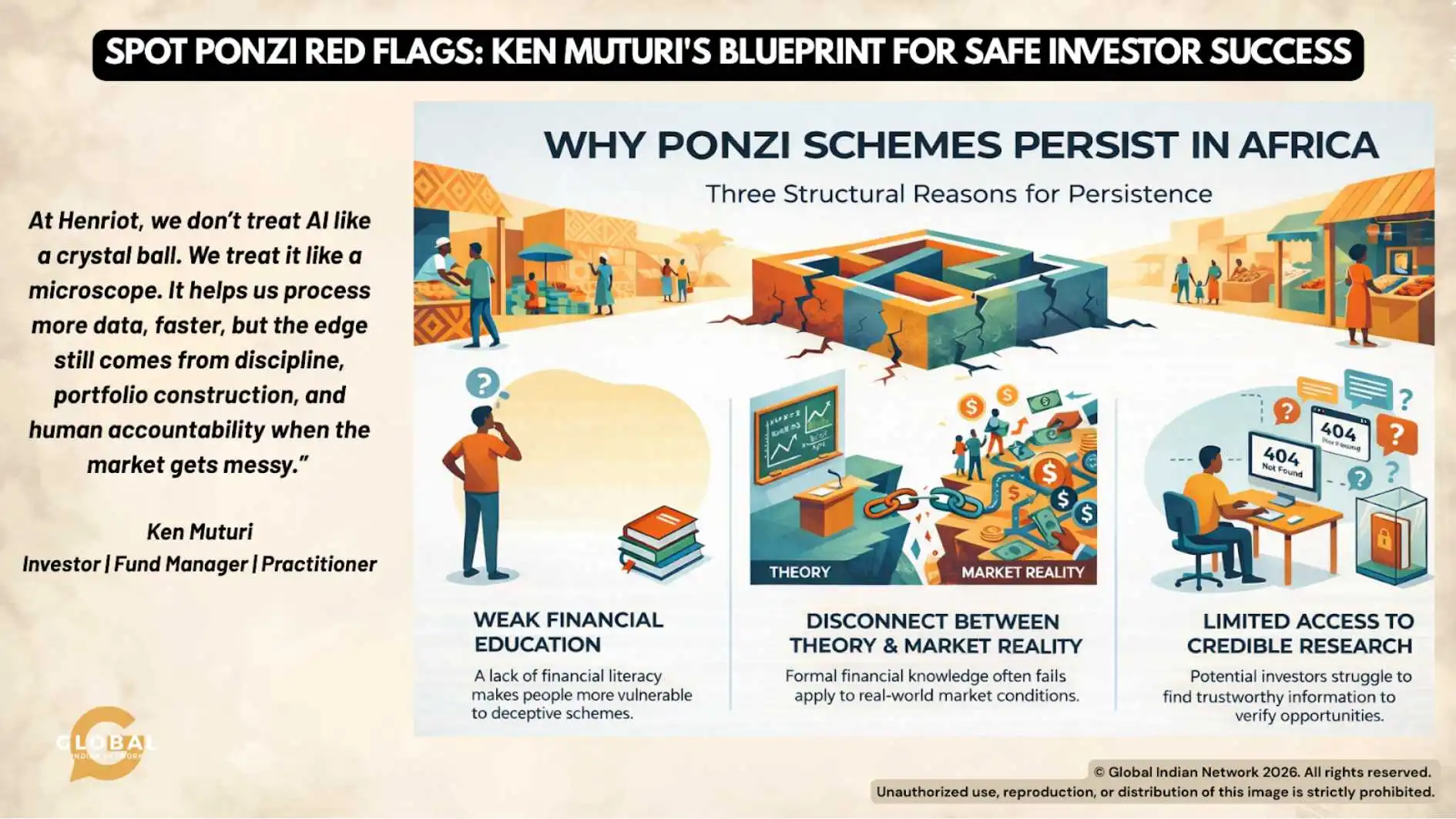

Why Ponzi Schemes Thrive

Ponzi schemes persist in Africa for structural reasons. Muturi points to three:

● weak financial education

● a disconnect between theory and market reality

● limited access to credible research

As capital markets deepen and investors search for higher yields, fraudulent schemes evolve alongside legitimate products. Polished dashboards, confident intermediaries, and urgency-driven narratives increasingly blur the line between innovation and deception, especially when investors lack the tools to interrogate how returns are generated.

Lessons From the Collapse: Patterns Behind Ponzi Schemes

Muturi’s caution is shaped by direct exposure. Over the years, he has reviewed multiple collapsed investment structures across East Africa, often after capital had already been lost. In nearly every case, the pattern was the same: promised returns were fixed and implausibly high, and payouts depended on continuous inflows rather than underlying economic activity.

What troubled him most was not the sophistication of the schemes but how easily they exploited informational gaps and the urgency they created. Muturi notes that when investors do not understand how money is actually being made, they tend to outsource judgment, a pattern he believes underlies many collapsed schemes.

AI as a Microscope, Not a Crystal Ball

Muturi argues that AI’s true value lies in augmentation, not automation. At Henriot Capital, AI is used to sift data, surface patterns, and test assumptions, but not to make final decisions independently.

“There’s definitely a human side behind it,” he says. “Data will give you the perfect score. But that perfect score is not necessarily what the market is representing.” Human judgment introduces necessary imperfection: context, skepticism, and restraint. At Henriot Capital, human judgment is only used as a validation layer for insights generated by the Quant Models.

Data can inform decisions, but markets remain shaped by fear, greed, elections, policy shocks, and behavioural bias – factors no model fully captures.”

– Ken Muturi

Excessive dependence on automated signals risks herding investors into crowded positions, inflating bubbles rather than mitigating risk.

Changing Investment Behaviour in East Africa

Investment behaviour in East Africa is evolving rapidly. Traditionally, wealth was stored in tangible assets: land, rental property, and savings circles. Over the past decade, money market funds, multi-asset funds, and global equities have gained traction, reflecting a growing willingness to take risks in pursuit of better returns.

This shift presents opportunity, but also danger. As Muturi observes, more investors are seeking yield without fully understanding the instruments they are using, a gap often exploited by fraudulent operators.

How Investors Can Protect Themselves

Smarter investing in the AI era requires a few non-negotiables:

- Understand how returns are generated, not just how they are reported.

- Be skeptical of guaranteed or fixed monthly returns.

- Verify regulatory oversight and transparency.

- Separate analytical tools from decision-makers.

- Avoid urgency-based offers that bypass due diligence.

Technology should support judgment, not replace it.

Henriot Capital is designed as a long-term compounding vehicle. The fund is built for investors who want a serious, patient solution for goals that sit years ahead. Things like retirement planning, or an education plan for a child who will need it 15 to 18 years from now. The philosophy is simple: focus on repeatable decisions, manage risk through different market regimes, and let time do what time does best.”

– Ken Muturi

Why Compounding Matters

In African contexts, compounding (listen to Muturi’s perspective) is deeply personal. It funds education, stabilizes families, and supports businesses across generations. Steady, repeatable returns matter more than spectacular but fragile gains. As Muturi frames it, disciplined compounding offers “a better way of building capital that most people don’t have.”

This perspective shifts investing away from speculation and toward stewardship – particularly critical in markets where volatility is a feature, not a flaw. Beyond theory and models, the real significance of compounding becomes clear when viewed through the everyday financial realities facing households across Africa.

Across much of Africa, the importance of compounding is not abstract – it is structural. With average pension replacement ratios estimated at around 55%, many retirees face a sharp drop in living standards once formal income ends. The challenge extends beyond income shortfalls to a lack of long-term, retirement-focused investment solutions built to compound steadily over decades rather than pursuing short-term gains. This is where disciplined compounding becomes tangible.

Long-term vehicles designed around disciplined compounding are built not as trading instruments, but as compounding engines – capable of funding retirement, education planning, and multi-generational goals through consistency and time. The real power of compounding lies in its cumulative impact: steady investing can finance a child’s education, stabilise household wealth, improve quality of life, and gradually build generational capital. In regions where volatility is common and safety nets are thin, compounding is not just a financial concept; it is a mechanism for dignity, resilience, and long-term economic mobility.

For Muturi, this is not an abstract observation but a lived economic reality. He often points to the harsh arithmetic of retirement across much of Africa, where pension replacement ratios hover around this structural gap, leaving households to navigate later life on a fraction of their working income. In that context, he argues, compounding becomes less about market theory and more about survival, dignity, and choice. What matters is not timing the market but committing early, staying consistent, and allowing time to do the heavy lifting. Over long horizons, Muturi notes, disciplined compounding can transform seemingly impossible goals, funding education, sustaining families, supporting enterprise, into achievable outcomes, creating stability not just for individuals, but across generations.

The Long Game

AI will shape the future of investing just as mobile money reshaped African finance. But the lesson from both revolutions is the same: speed must be matched with safeguards.

Technology determines how fast investors move. Judgment determines where they end up.

For regions navigating rapid wealth creation alongside persistent inequality, smarter investing is not about predicting the future. It is about avoiding preventable mistakes and allowing time, discipline, and transparency to do their work.

For practitioners like Muturi, the challenge is not adopting new tools, but integrating them responsibly into systems that must perform across cycles.

The perspective outlined above reflects Muturi’s broader approach to investing and impact.

About Ken Muturi

Ken Muturi is the Founder, Co-CIO, and Fund Manager at Henriot Capital LLC, a US-domiciled, long-only investment fund built around a GARP (Growth at a Reasonable Price) framework and focused on US-listed equities. The fund is offered via a private placement under Rule 506(b) and is designed for accredited investors seeking a disciplined, transparent investment process.

Henriot Capital is managed using a quant-led approach that blends systematic data-driven models with a fundamental overlay, prioritising consistency, repeatability, and risk discipline across market cycles.

Beyond performance, Muturi’s vision emphasises access and long-term impact. He believes that enabling African investors to participate meaningfully in global capital markets and repatriating those returns into local economies can raise living standards and build durable, intergenerational wealth over time.

Muturi’s background is in quantitative analysis. He previously led quantitative trading at a boutique hedge fund in Seychelles and holds a degree in Actuarial Science from Strathmore University, Nairobi, as well as the EPAT certification from QuantInsti, India.