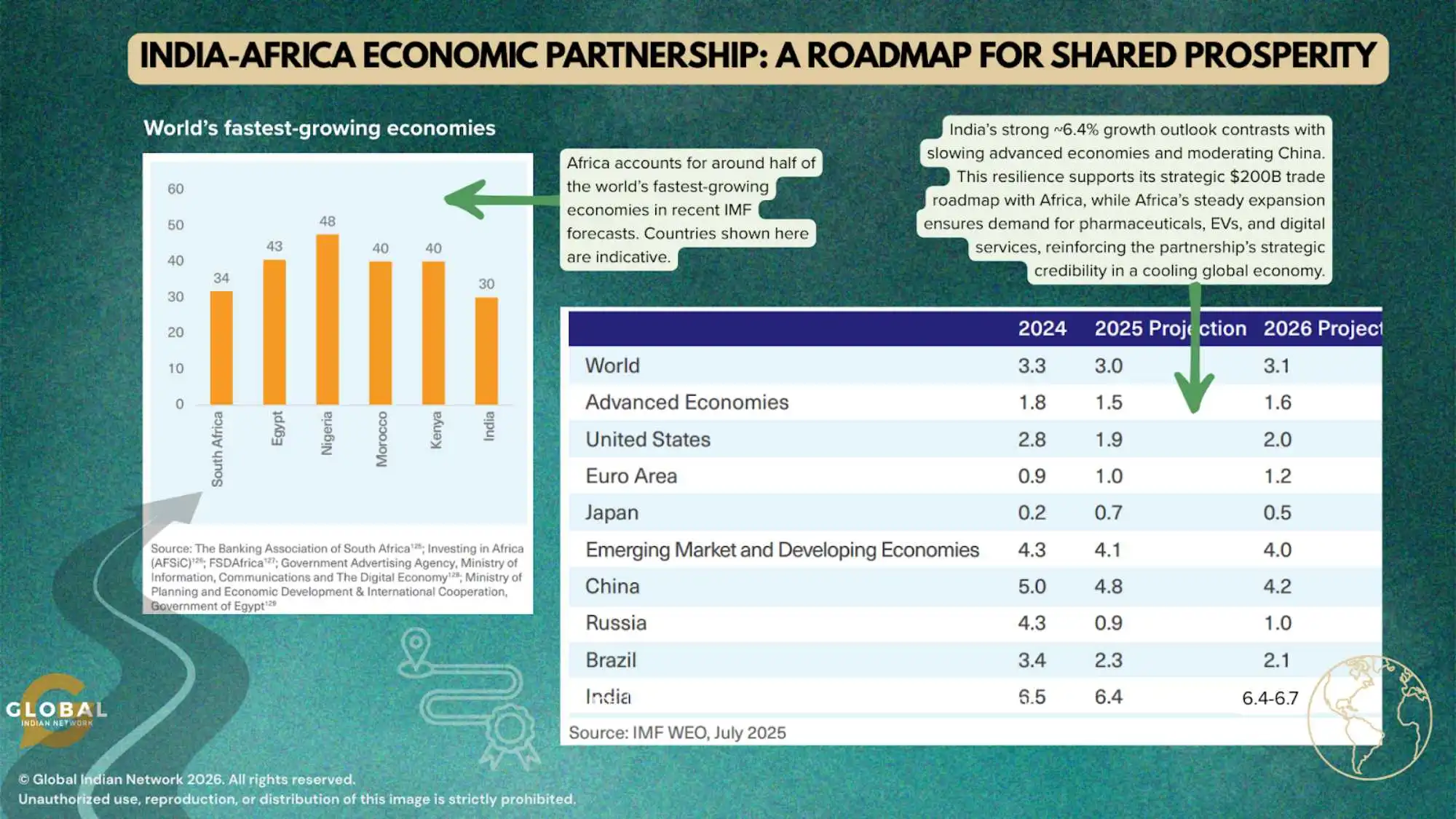

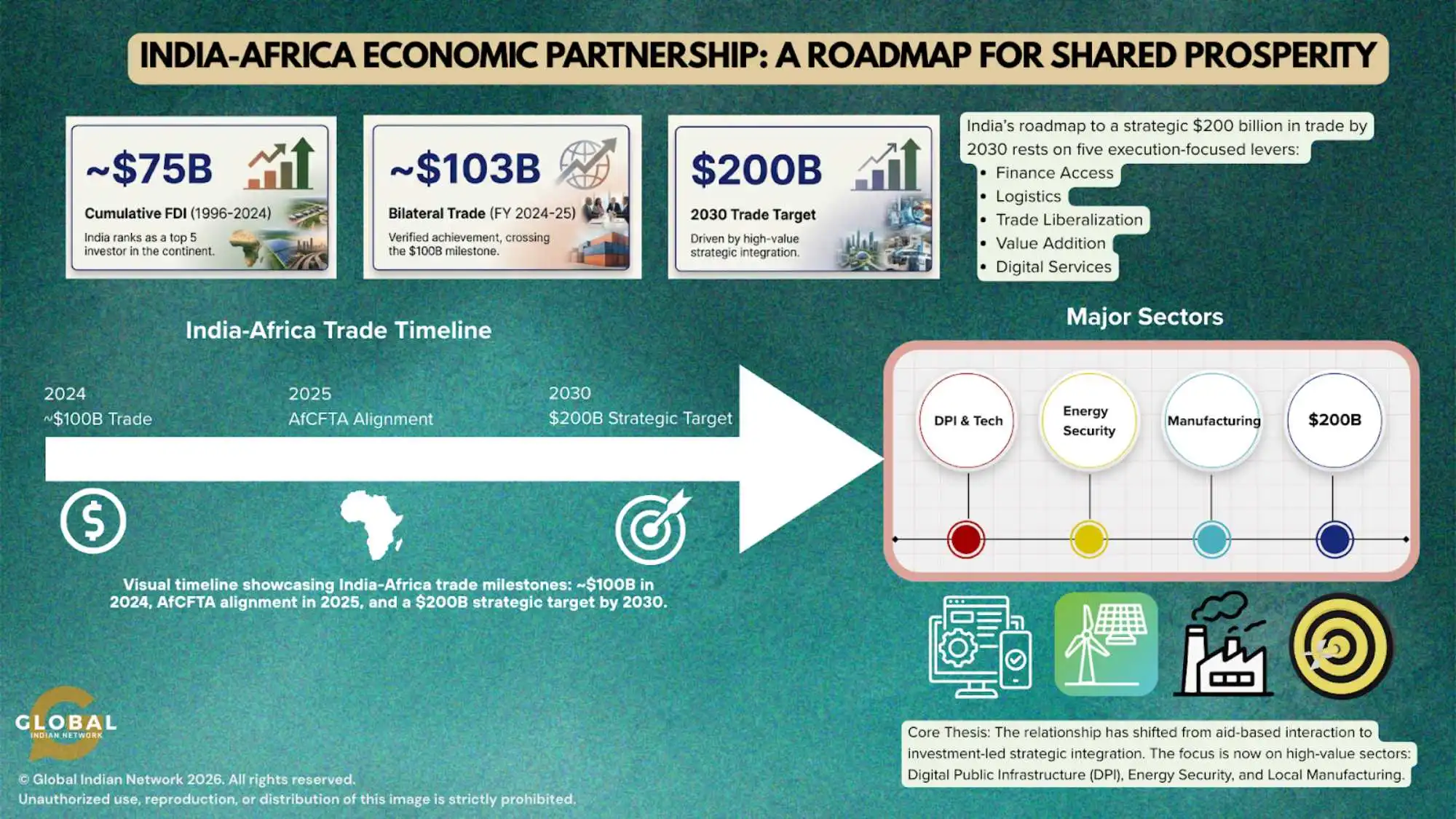

India and Africa are entering a decisive new phase in their economic relationship – one that moves beyond post-colonial solidarity and development aid toward a mature, investment-led partnership designed for mutual growth. This transition is no longer aspirational. Bilateral trade exceeded $100 billion in 2024–25, positioning the India–Africa corridor as one of the most strategically important economic relationships in the Global South.

This partnership reflects a deeper structural alignment. India offers Africa affordable technology, scalable digital public infrastructure, and sustainable finance. Africa, in turn, provides India with access to fast-growing markets, critical energy resources, and minerals essential for the global green transition. Together, they are building a model of cooperation rooted in co-development rather than dependency.

This article examines the evolution of the India–Africa economic partnership, dissects the composition of bilateral trade, evaluates key strategic pillars, identifies structural challenges, and presents a clear roadmap to achieve approximately $200 billion in trade by 2030.

Table of Contents

From Solidarity to Strategy: The Evolution of the Partnership

The foundations of the India–Africa relationship were laid during the anti-colonial era, shaped by shared political values and South–South solidarity. Over the last two decades, however, this relationship has undergone a profound transformation – shifting from aid-driven engagement to a strategy centered on investment, trade integration, and local capacity building.

By 2025, development aid accounted for less than 15% of India’s financial engagement with Africa. In contrast, cumulative Indian investments reached an estimated $75–80 billion across manufacturing, pharmaceuticals, energy, agriculture, and services. This pivot reflects a conscious effort to avoid debt-heavy engagement models and instead promote sustainable, commercially viable growth.

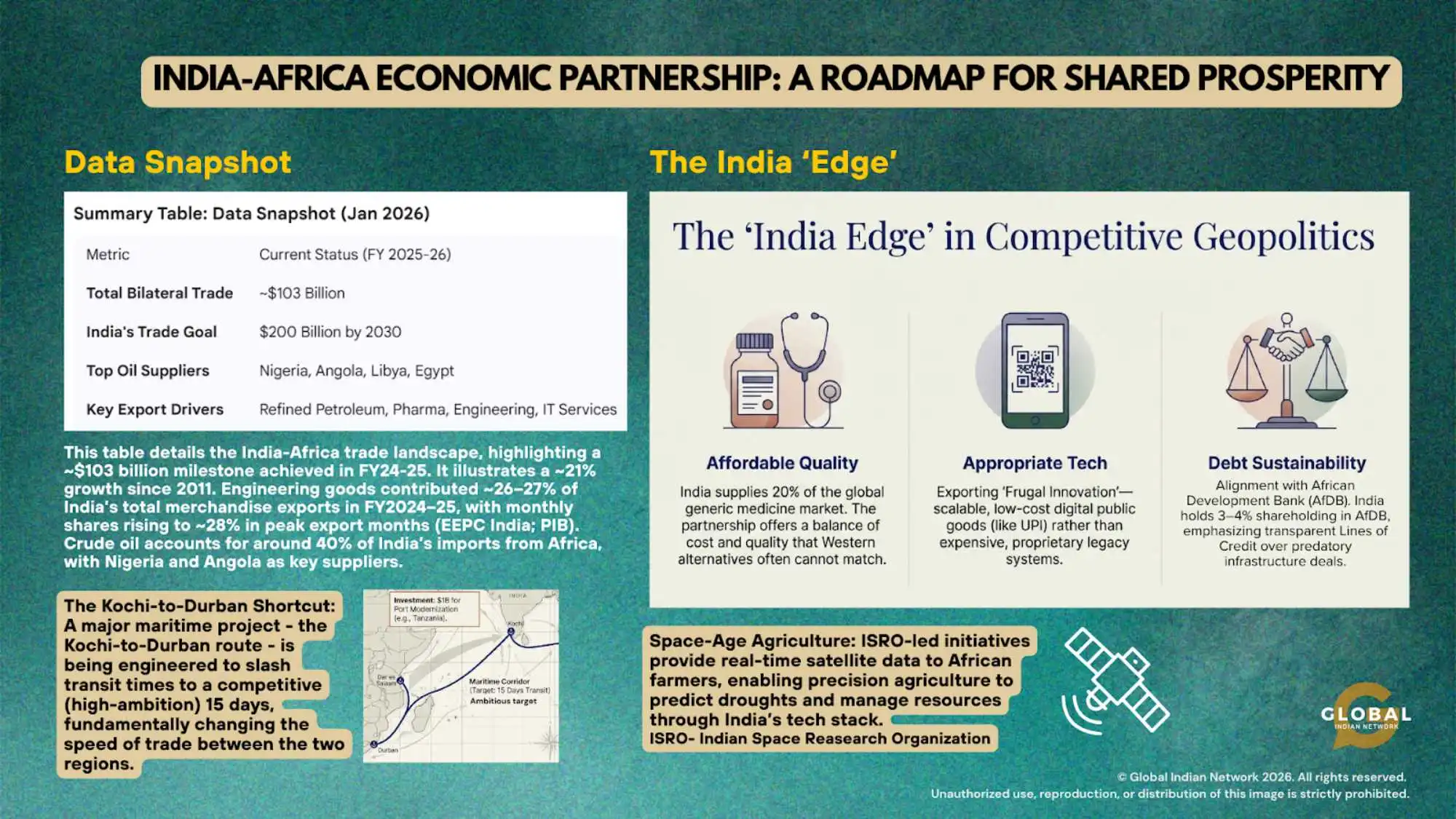

| Sector | Data Point | Primary Source(s) |

| Bilateral Trade | $100B+ (2024–25) | Press Information Bureau (PIB): Statement by Minister of State Kirti Vardhan Singh at the 20th CII India-Africa Business Conclave (Aug 2025). |

| Pharmaceuticals | $3.9B (Africa focus) | Pharmexcil (Pharmaceuticals Export Promotion Council): Handbook 2025 and DGCIS data, noting Africa’s ~12.91% share of India’s $30.4B total pharma exports. |

| Crude Oil | ~8% Share | PPAC (Petroleum Planning & Analysis Cell): Monthly Reports 2025, citing regional import shares where Africa (Nigeria/Angola) consistently supplies ~5.4% to 8% of the monthly basket. |

| Critical Minerals | NCMM Launch | Ministry of Mines: National Critical Mineral Mission (NCMM) – 2025 Roadmap, identifying 30 critical minerals and the sovereign fund of ₹34,000 Crores for domestic and foreign acquisition. |

| Investment | $75B Cumulative | Ministry of External Affairs (MEA) / CII: Reported at the 2025 India-Africa Business Enclave, confirming India as one of Africa’s top five investors (1996–2024). |

India’s financial approach is closely aligned with multilateral norms. As the second-largest non-regional shareholder in the African Development Bank (AfDB), India channels financing through transparent, rules-based institutions, thereby reinforcing African ownership of development priorities. This model resonates strongly with Agenda 2063, Africa’s long-term development blueprint.

Equally important is India’s emphasis on self-reliance and technology transfer. Unlike extractive trade relationships, Indian projects increasingly prioritise localisation – training local workforces, developing supplier ecosystems, and building long-term industrial capacity.

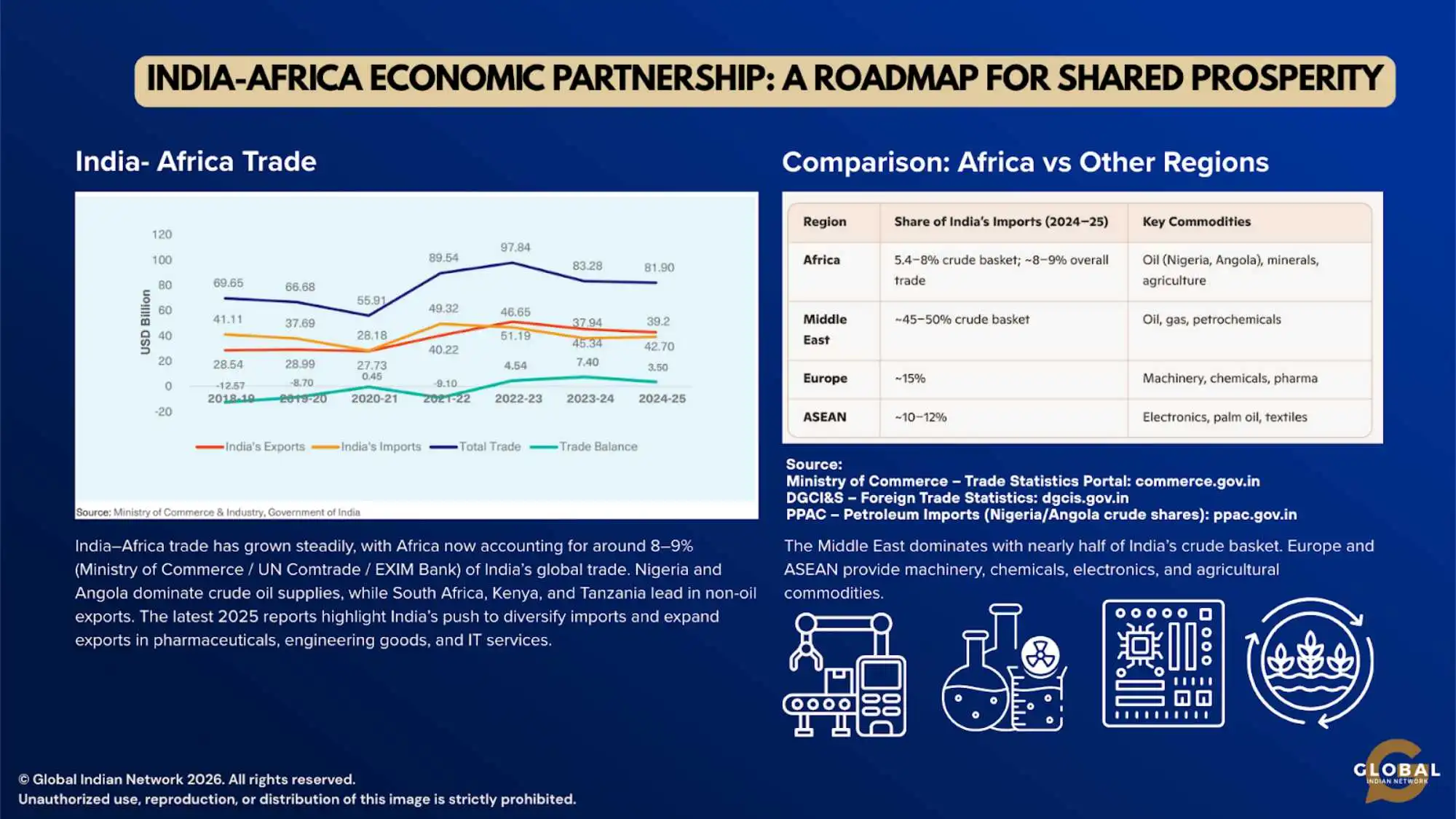

The Anatomy of $100 billion in Bilateral Trade

Crossing the $100 billion trade mark is not merely symbolic; it reflects a deeply complementary economic structure.

India’s Exports to Africa

Indian exports account for roughly 70% of bilateral trade, led by:

- Pharmaceuticals: Over $10 billion annually, with Indian firms supplying 55–60% of Africa’s generic medicines and vaccines

- Machinery and transport equipment, supporting infrastructure, and industrialization

- Textiles and consumer goods serving Africa’s expanding middle class

India’s competitive advantage lies in delivering high-quality, low-cost solutions tailored to developing markets, an edge often described as the “India model.”

Africa’s Exports to India

Africa plays a critical role in India’s resource security:

- Supplies approximately 20% of India’s crude oil imports

- Provides strategic minerals such as cobalt, manganese, copper, and lithium, essential for electric vehicles and renewable energy storage

These resource flows underpin India’s ambition to reach 500 GW of renewable energy capacity by 2030.

While China remains Africa’s largest trading partner (over $200 billion in trade), India’s approach stands out for affordability, local capacity building, and digital inclusion, particularly in healthcare and financial services.

Strategic Pillars of Collaboration

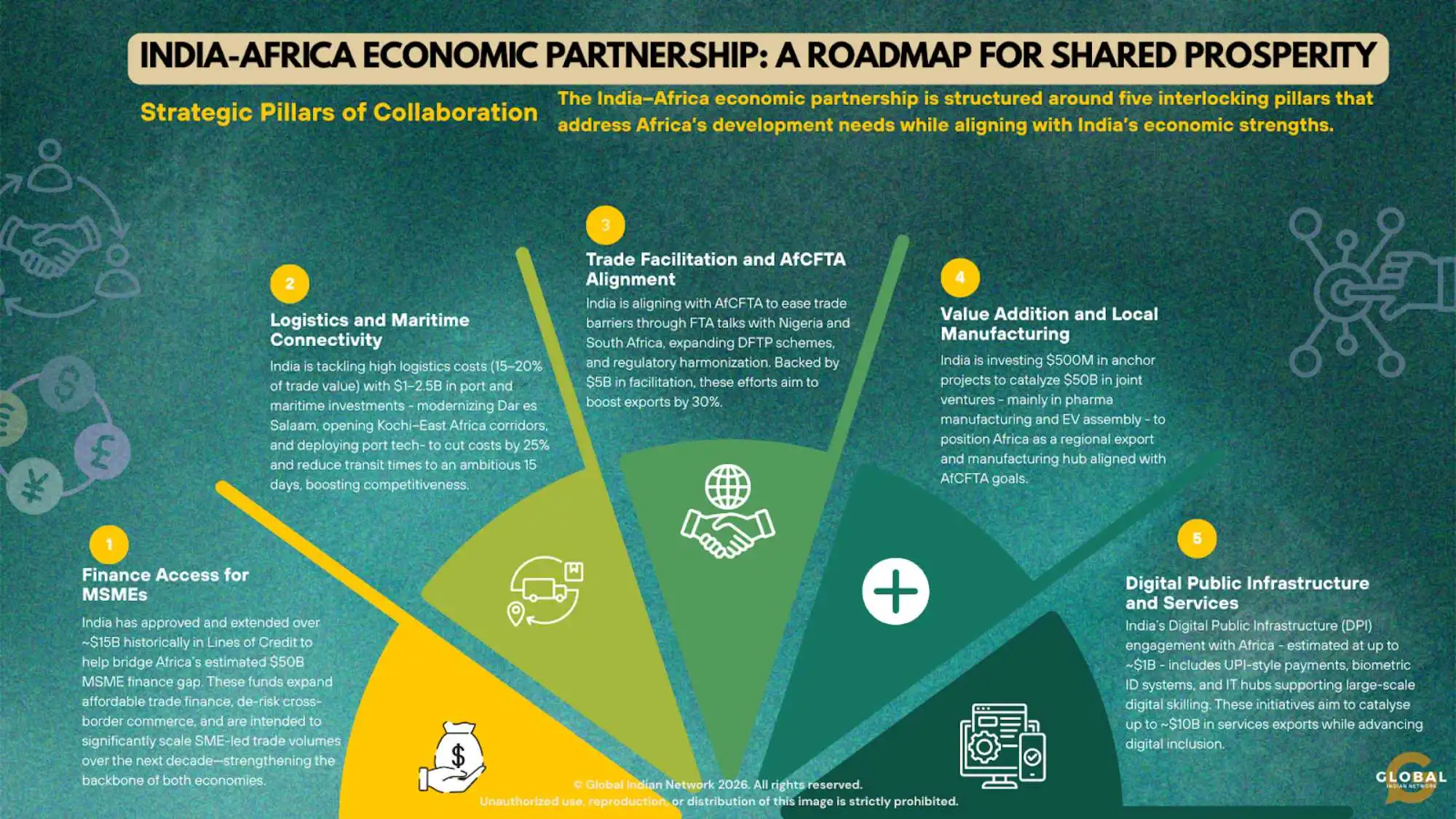

The India–Africa economic partnership is structured around five interlocking pillars that address Africa’s development needs while aligning with India’s economic strengths.

Finance Access for MSMEs

India has committed $20 billion in Lines of Credit (LoCs) to bridge the financing gap faced by micro, small, and medium enterprises (MSMEs). These LoCs are designed to:

- Expand access to affordable trade finance

- De-risk cross-border commerce through ECGC insurance

- Double SME-led trade volumes over the next decade

MSMEs form the backbone of both economies, and closing Africa’s estimated $50 billion MSME finance gap is critical to inclusive growth.

Logistics and Maritime Connectivity

High logistics costs – often 15–20% of trade value – remain a major bottleneck. India is addressing this through $1–2.5 billion in maritime and port investments, including:

- Modernization of ports such as Dar es Salaam

- Development of direct maritime corridors, including Kochi–East Africa routes

- Deployment of Indian port-management technology

These initiatives aim to reduce logistics costs by 25% and to cut transit times to approximately 15 days, thereby significantly improving trade competitiveness.

Trade Facilitation and AfCFTA Alignment

India is aligning its trade framework with the African Continental Free Trade Area (AfCFTA) to reduce trade barriers. Key initiatives include:

- Negotiations for Free Trade Agreements with Nigeria and South Africa

- Expansion of Duty-Free Tariff Preference (DFTP) schemes

- Joint Trade Committees for regulatory harmonization

India has earmarked approximately ~$5 billion to support trade facilitation efforts, with exports projected to increase by 30%.

Value Addition and Local Manufacturing

Moving beyond raw-material trade, India is investing roughly $500 million in anchor projects to catalyze ~$50 billion in joint ventures, particularly in:

- Pharmaceutical manufacturing hubs

- Automotive and EV assembly plants (e.g., Ghana)

These initiatives aim to reposition Africa as a manufacturing and export base, aligned with AfCFTA’s integrated market vision.

Digital Public Infrastructure and Services

India’s most transformative export may be its Digital Public Infrastructure (DPI) model. With a $1 billion commitment, India is supporting:

- Digital payments inspired by UPI

- Biometric ID systems improving governance

- IT hubs and digital skills training for 1 million African youth

The target is $10 billion in services exports, while enabling digital inclusion for hundreds of millions.

Strategic Pillars of Collaboration – Summary

| Strategic Driver | Roadmap Target (2030) | Current Status (FY 2025-26) |

|---|---|---|

| Bilateral Trade | $200 Billion | $103 Billion |

| Manufacturing | $50B Joint Ventures | $500M Anchor Projects |

| Consumer Market | $2.5T Consumption | 3.9% Annual Growth |

| Energy Security | 20% Import Share | ~40% of Africa Imports |

| Logistics | 25% Cost Reduction | 15–20% Current Cost |

Overcoming Structural Barriers

Despite strong momentum, two structural challenges continue to constrain growth.

Logistics Inefficiencies

Logistics costs between India and Africa are nearly double those on India–ASEAN routes. Addressing port congestion, shipping frequency, and digital customs systems remains essential.

Trade Finance Constraints

MSMEs face high borrowing costs and limited access to insurance. Expanded LoCs, blended finance with AfDB, and stronger export credit guarantees are central to closing this gap.

Roadmap to 2030: Doubling Trade to $200 Billion

India’s roadmap to ~$200 billion in trade by 2030 rests on five execution-focused levers:

| Pillar | Focus | Projected Impact |

| Trade Liberalization | FTAs, AfCFTA alignment | +30% exports |

| Value Addition | Pharma, auto, EVs | $50B JVs |

| Finance Access | $20B LoCs | 2× SME trade |

| Logistics | Ports, corridors | −25% costs |

| Digital Services | IT hubs, skilling | $10B exports |

Execution will be led by a combination of commerce ministries, EXIM Bank, AfDB, port authorities, and digital regulators.

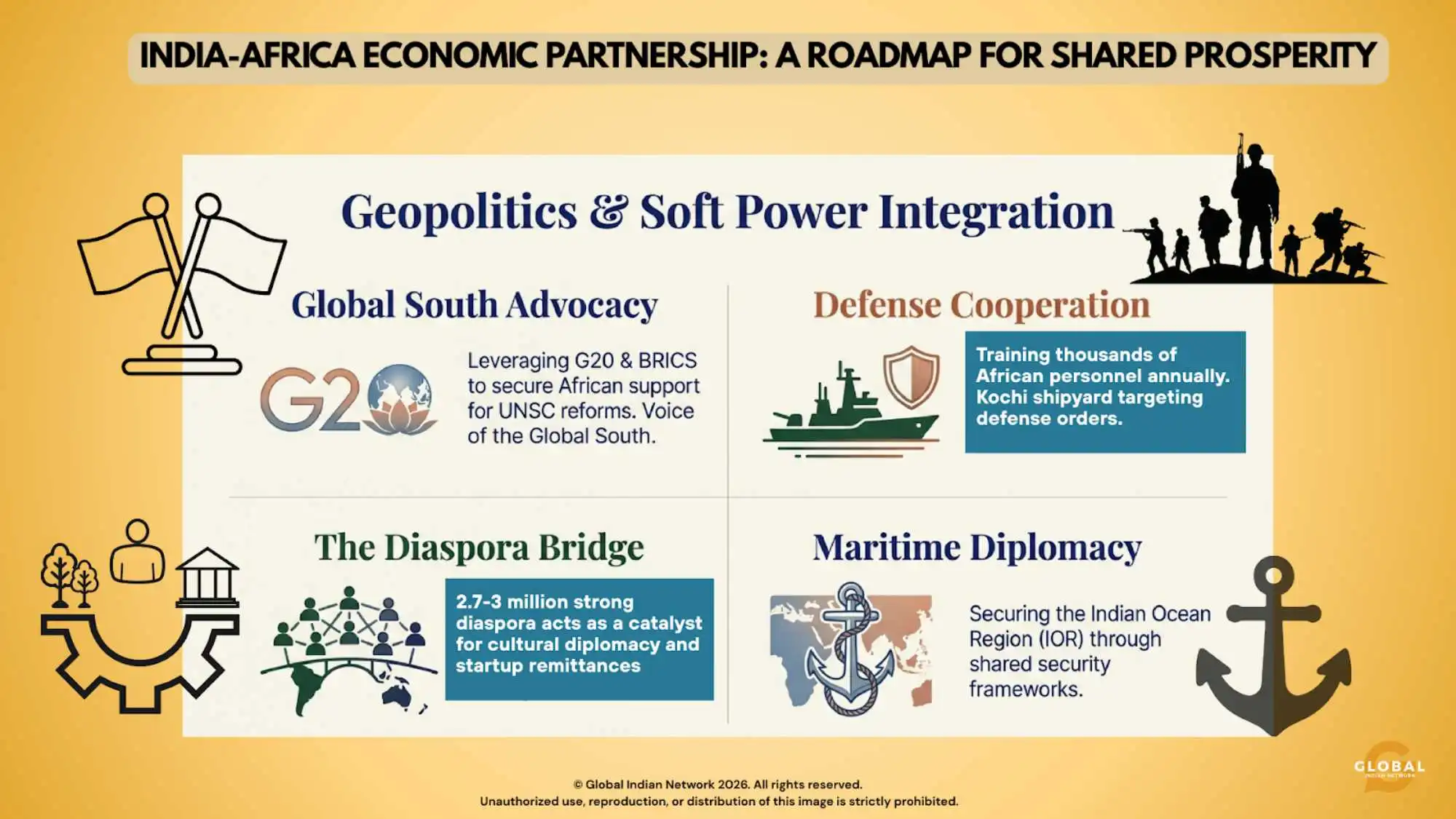

Geopolitical and Cultural Foundations

Economic cooperation is reinforced by deep geopolitical alignment.

- Global South leadership: India leverages forums such as G20 and BRICS to amplify African priorities

- Security cooperation: Joint military exercises and training of over 5,000 African personnel annually

- Diaspora linkages: A 2.7-3-million-strong Indian diaspora acts as a bridge for trade, investment, and startups

Sub-national ties, such as Kerala’s shipbuilding engagement with African ports, are adding a new layer of decentralized cooperation.

Conclusion: A Partnership Shaping Global Growth

The India–Africa economic partnership has evolved into a strategic, future-oriented alliance grounded in mutual benefit. With trade exceeding $100 billion and a credible roadmap to ~$200 billion by 2030, the relationship is moving decisively toward value addition, digital services, and green growth.

Challenges remain, from logistics inefficiencies to global tariff volatility, but India’s development-centric model offers resilience. Its focus on affordable healthcare, digital inclusion, and climate-sensitive investment aligns closely with Africa’s long-term priorities.

As Africa’s population approaches 1.4 billion by 2050, opportunities will expand into advanced sectors such as semiconductors, clean energy manufacturing, and next-generation telecommunications. By continuing to build on trust, co-development, and institutional cooperation, the India–Africa partnership is poised to become a cornerstone of 21st-century global growth.

Stay with us at Global Indian Network to align with the growth.

Sources & Further Reading:

- TRADESTAT

- Press Release: Press Information Bureau

- Exim Bank: Home

- India-Nigeria Bilateral Economic & Commercial Relations

- India’s foreign trade rebounds in 2025 as reforms, digitisation and global partnerships strengthen economic outlook | DD News

- IndiaAfrica – A shared future | MEA

- UN Comtrade

- Mcommerce

- Trade

Methodology

This article is based on publicly available data and policy materials from the Ministry of External Affairs and Ministry of Commerce (India), UN Comtrade, EXIM Bank of India, the African Development Bank (AfDB), the AfCFTA Secretariat, and the World Bank. Trade figures reflect the latest fiscal-year estimates (FY2024–25) and are reported in nominal USD.

Charts and infographics are compiled by the author to illustrate key trends and strategic priorities. Forward-looking projections and targets are indicative, based on policy statements and institutional estimates, and do not constitute forecasts or guarantees.