Banking crises don’t begin with apps; they begin with weak governance.

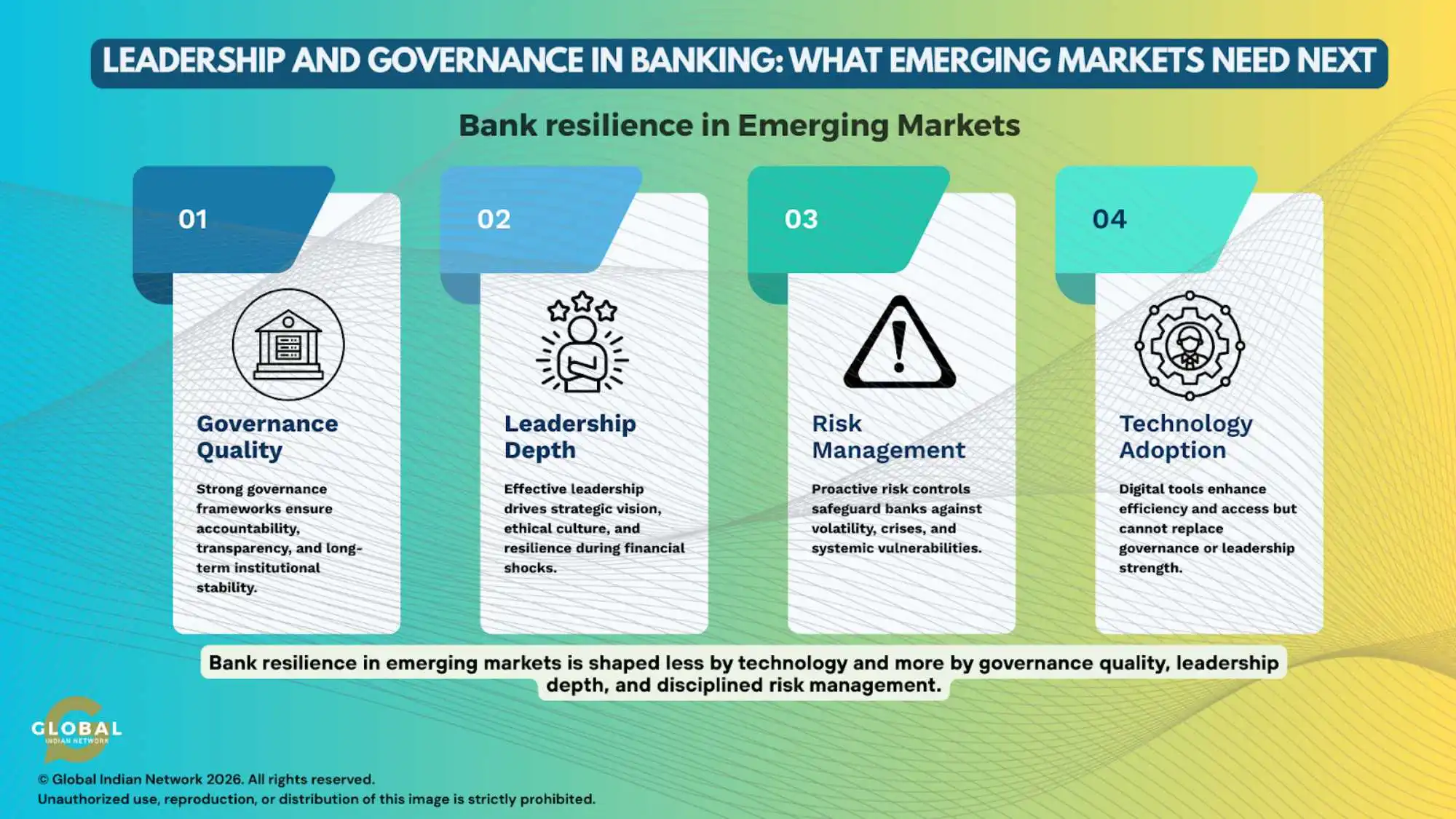

In many emerging markets, the conversation around banking reform is dominated by technology: digital wallets, mobile lending, AI-driven credit scoring, and fintech disruption. While these tools matter, they are not the foundation of durable financial systems. The real differentiator between fragile banking ecosystems and resilient ones lies elsewhere, in leadership quality, governance discipline, and institutional maturity.

Table of Contents

As emerging economies across Africa and Asia deepen financial access and integrate into global capital markets, the next phase of banking evolution will depend less on speed and more on how institutions are led.

Why Governance Is the New Competitive Advantage

Emerging-market banks operate under intense pressure: rapid population growth, underbanked segments, volatile macro conditions, and increasing regulatory scrutiny. In this environment, weak governance doesn’t merely slow progress – it amplifies systemic risk.

Strong governance manifests in:

- clear separation between ownership, management, and oversight

- boards with real independence and sector expertise

- disciplined risk management frameworks

- leadership succession planning beyond founders or dominant executives

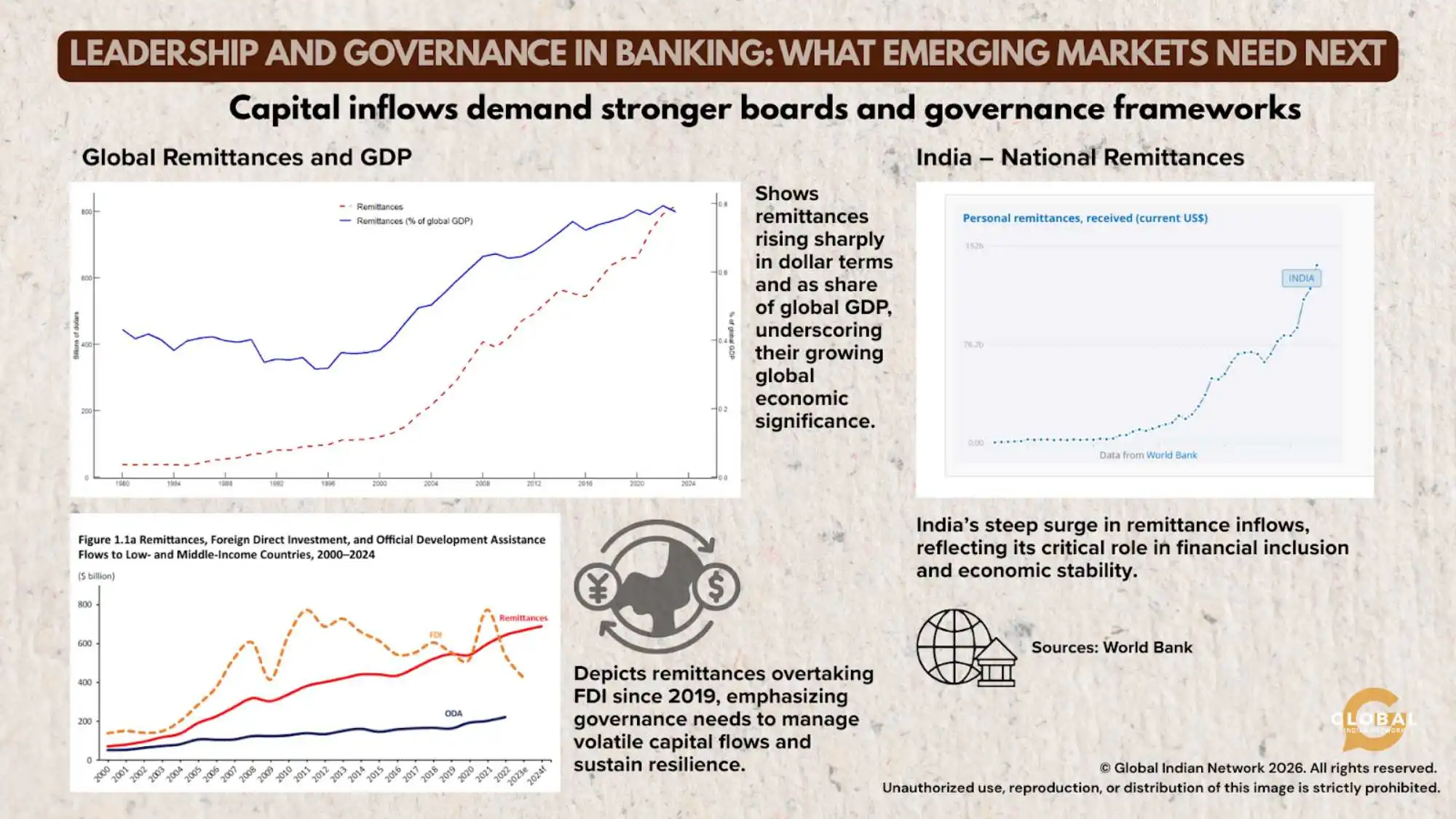

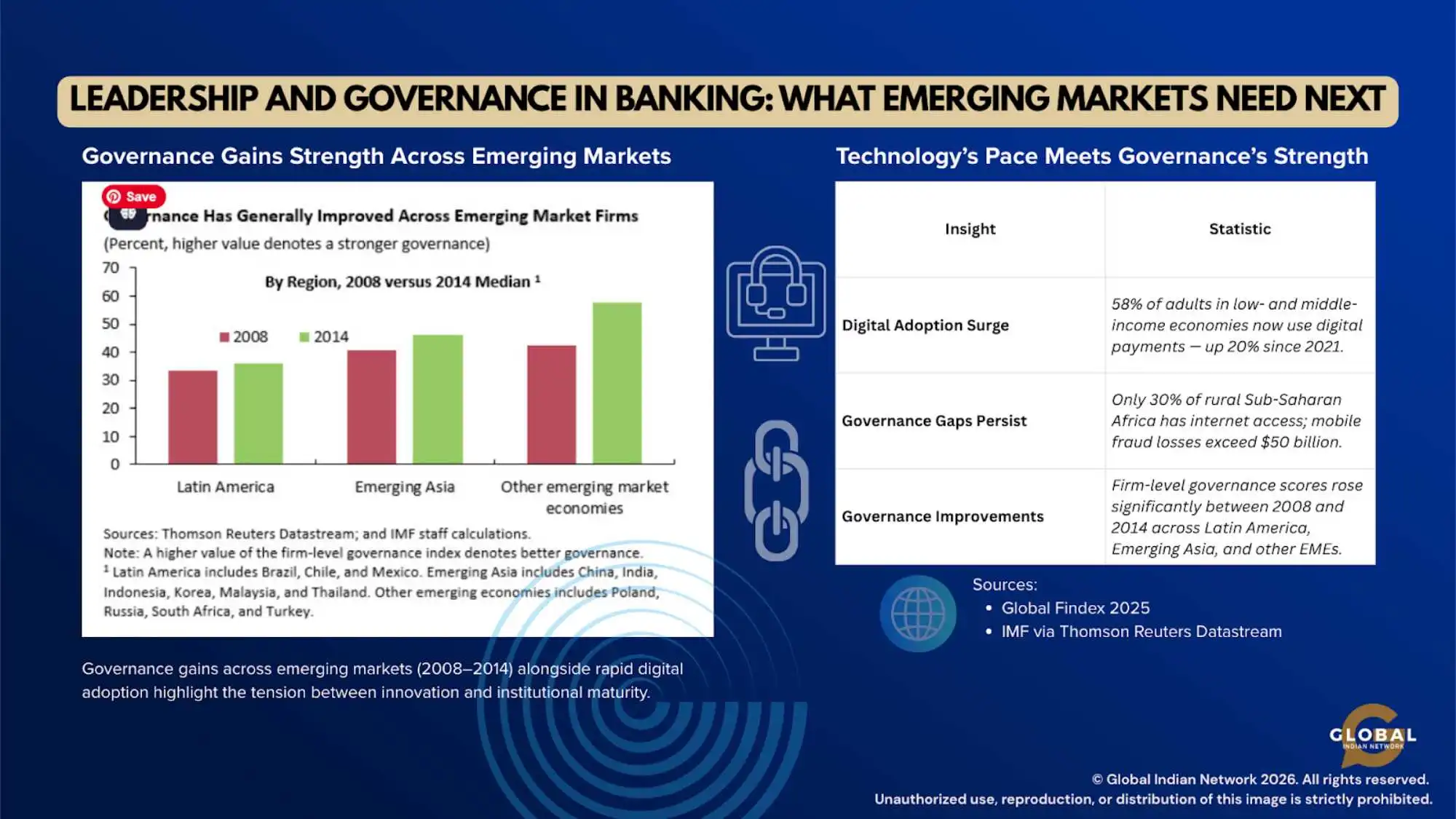

Firm-level governance has strengthened across emerging markets over time, reinforcing the role of institutional quality in financial resilience.

Banks that institutionalize these practices are better positioned to absorb shocks, attract long-term capital, and scale responsibly.

As Ajay Banga, President of the World Bank, has emphasized, today’s financial landscape demands stronger institutions and disciplined governance to withstand volatility.

Declining progress in poverty reduction, mounting debt, and food insecurity demand stronger institutions and disciplined governance to withstand shocks.”

– (World Bank Annual Report, 2024)

Leadership Beyond the Balance Sheet

Banking leadership today extends far beyond financial performance. CEOs and boards are now custodians of:

- public trust

- financial inclusion mandates

- regulatory alignment

- environmental and social risk exposure

In emerging markets, this responsibility is magnified. Banks often function as development enablers – financing SMEs, agriculture, infrastructure, and first-time borrowers. Poor leadership choices can therefore ripple across entire economies.

Effective leaders in this context share common traits:

- long-term thinking over quarterly optics

- comfort with regulation as a partner, not an obstacle

- investment in people and institutional memory

- willingness to say “no” to unsustainable growth

These are not glamorous attributes, but they are decisive.

The India–Africa Parallel

India and Africa offer strikingly similar banking challenges:

- large informal economies

- millions of first-time financial users

- fast digital adoption layered onto legacy systems

- evolving regulatory frameworks

India’s banking reforms, from Aadhaar-enabled KYC to UPI, demonstrate how strong public infrastructure combined with disciplined institutional governance can scale inclusion without destabilizing the system. Africa’s banking sector, meanwhile, has shown remarkable innovation in mobile money and alternative finance models.

The India–Africa comparison is not about technology models- it is about institutional sequencing. The shared lesson is clear: technology accelerates progress, but governance determines outcomes.

| Insight | Statistic |

| Digital Adoption Surge | 58% of adults in low- and middle-income economies now use digital payments — up 20% since 2021. |

| Governance Gaps Persist | Only 30% of rural Sub-Saharan Africa has internet access; mobile fraud losses exceed $50 billion. |

| Governance Improvements | Firm-level governance scores rose significantly between 2008 and 2014 across Latin America, Emerging Asia, and other EMEs. |

This creates space for meaningful cross-regional dialogue – not just between fintechs, but between boards, regulators, and senior banking leaders who understand institution-building at scale.

Resilience in a world of uncertainty requires stronger institutions, sound fiscal frameworks, and governance that earns public trust.”

– (IMF Annual Meetings, 2025) – Kristalina Georgieva (IMF Managing Director)

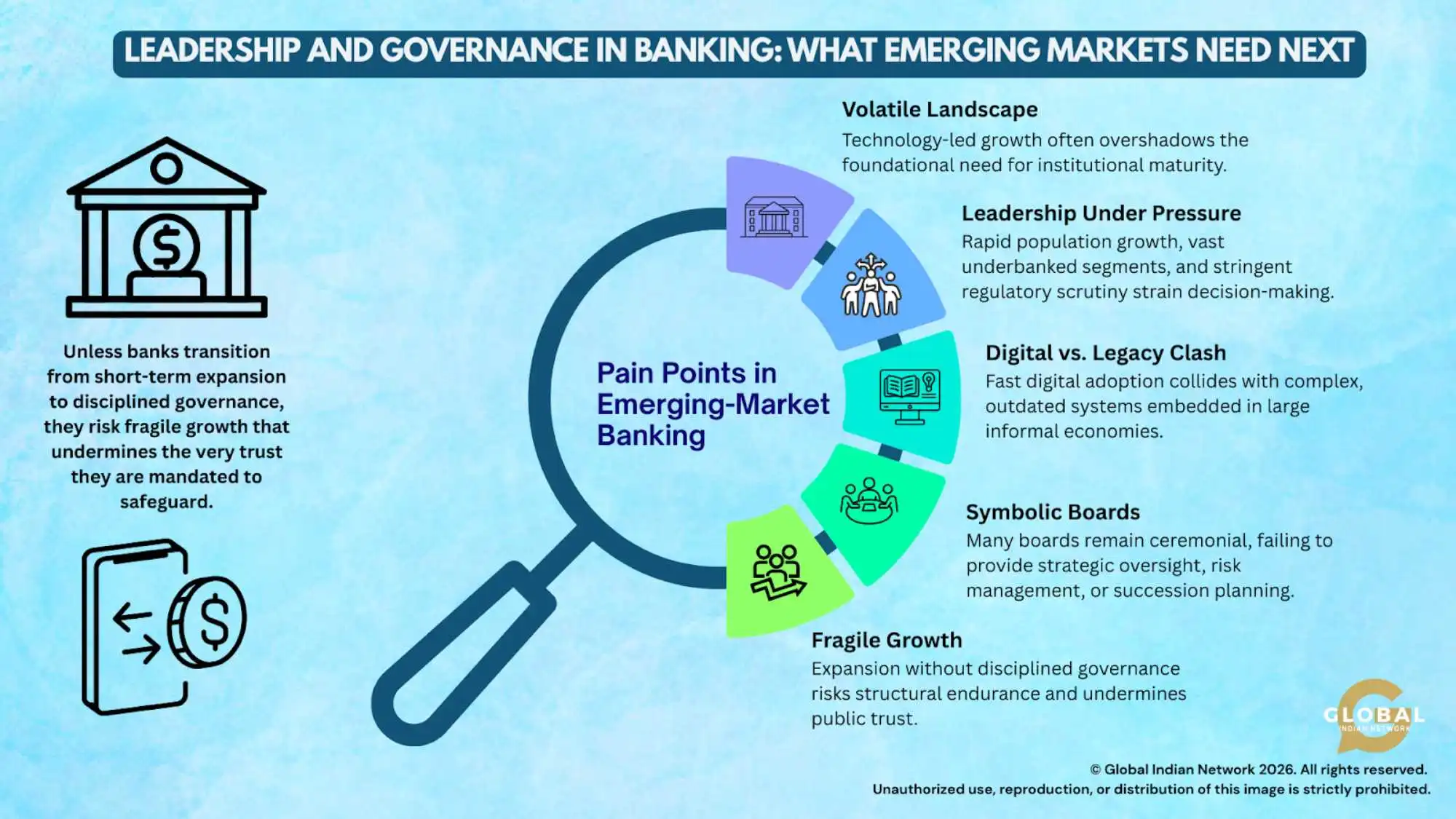

Pain Points in Emerging-Market Banking

Emerging-market banking operates in a volatile landscape where technology often overshadows the foundational need for institutional maturity. Leaders operate under intense pressure from rapid population growth, vast underbanked segments, and increasingly stringent regulatory scrutiny.

A critical pain point is the tension between rapid digital adoption and the complexity of legacy systems in large informal economies. Furthermore, boards often remain symbolic rather than strategic, failing to address systemic risks or to plan for long-term succession. Without transitioning from short-term expansion to disciplined governance, these institutions risk fragile growth that outpaces structural endurance, threatening the public trust they must safeguard.

Boards Matter More Than Ever

One of the most under-discussed issues in emerging-market banking is board effectiveness. Too often, boards are symbolic rather than strategic. As financial systems mature, this becomes untenable.

High-performing banks increasingly rely on boards that:

- challenge management constructively

- understand both global standards and local realities

- actively oversee risk, compliance, and culture

- plan leadership transitions years in advance

This is where experienced banking professionals, advisors, and independent directors add disproportionate value – not through visibility, but through judgment.

Financial sector reforms succeed only when governance frameworks are robust – without them, growth is fragile and crises inevitable.”

– (Committee on Financial Sector Reforms, 2009) , Raghuram Rajan

From Expansion to Endurance

The next decade will separate banks built for expansion from banks built for endurance.

Institutions that survive and thrive will be those that:

- embed governance before crisis forces reform

- develop leaders, not just executives

- treat risk management as a responsibility

- align growth with technology that supports resilience, not a marketing slogan

For emerging markets, this shift is not optional. It is the price of credibility in a global financial system that increasingly rewards transparency, stability, and long-term stewardship.

Conclusion: From Inflows to Endurance

Emerging-market banking stands at a crossroads. Technology and capital inflows accelerate progress, but they cannot substitute for governance discipline and depth of leadership. The next decade will reward institutions that embed resilience before crisis forces reform, cultivate boards that are strategic rather than symbolic, and align growth with public trust.

India and Africa’s parallel journeys show that while digital adoption and remittance inflows expand opportunity, only governance ensures endurance. For emerging markets, this is not a choice – it is the price of credibility in a global financial system that increasingly values transparency, stability, and stewardship.

Integrity is better capital than money. You can accumulate it just like money, and you can use it just like money, but it goes further, and is enduring.”

– Strive Masiyiwa, Founder & Executive Chairman, Econet Group

These are conversations worth advancing across borders, sectors, and leadership circles – because in banking, progress that outpaces governance is not innovation. It is a risk.

This dialogue deserves to be advanced across Africa–India leadership circles. At Global Indian Network, we continue to share updates and insights that strengthen this exchange.