Can a community drive markets and institutions, or even a nation?

India’s 35-million-strong global community is far more than a demographic; it is a strategic asset. Spanning the US, UAE, and beyond, the diaspora drives bilateral trade and fuels domestic growth through a mix of financial remittances and political advocacy. As India targets 2047 for its transition to a developed economy, this global network remains an indispensable partner in that journey.

The Indian diaspora, numbering around 35 million worldwide, serves as a vital economic bridge linking India with global markets and governments through remittances, investments, and diplomatic advocacy. Spanning major hubs like the US (over 5 million), the UAE (~3.25 million), and Saudi Arabia, this community drives bilateral ties and trade flows. Their multifaceted role fuels India’s growth toward a developed economy.

Table of Contents

Diaspora Scale and Distribution

India has the world’s largest emigrant population, comprising ~17 million NRIs and ~18 million PIOs. This demographic is strategically concentrated in high-growth regions, led by the US (5.16–5.69 million) and followed by the UAE, Saudi Arabia, and Canada. By dominating sectors like technology, healthcare, and entrepreneurship, the diaspora creates a seamless economic corridor linking Silicon Valley to the Gulf’s commercial hubs.

The diaspora’s regional contributions are pivotal to India’s global economic strategy:

Africa: Driving capital into high-growth sectors like IT and pharmaceuticals.

Europe: Serving as the backbone of a ~$120 billion bilateral trade flow with the EU.

West Asia: Accelerating digital integration through the expansion of India’s payment systems (UPI) across the UAE and Qatar.

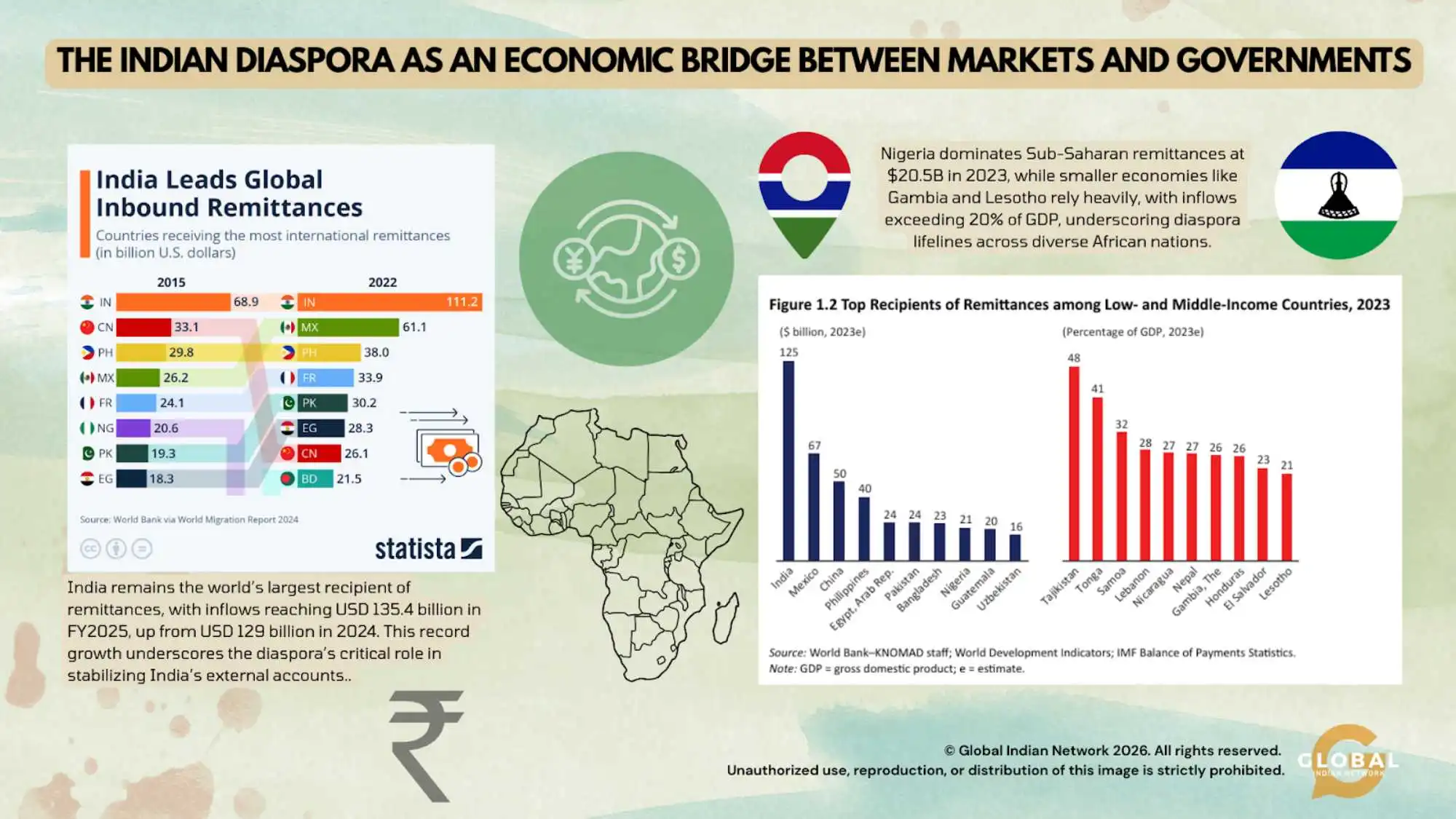

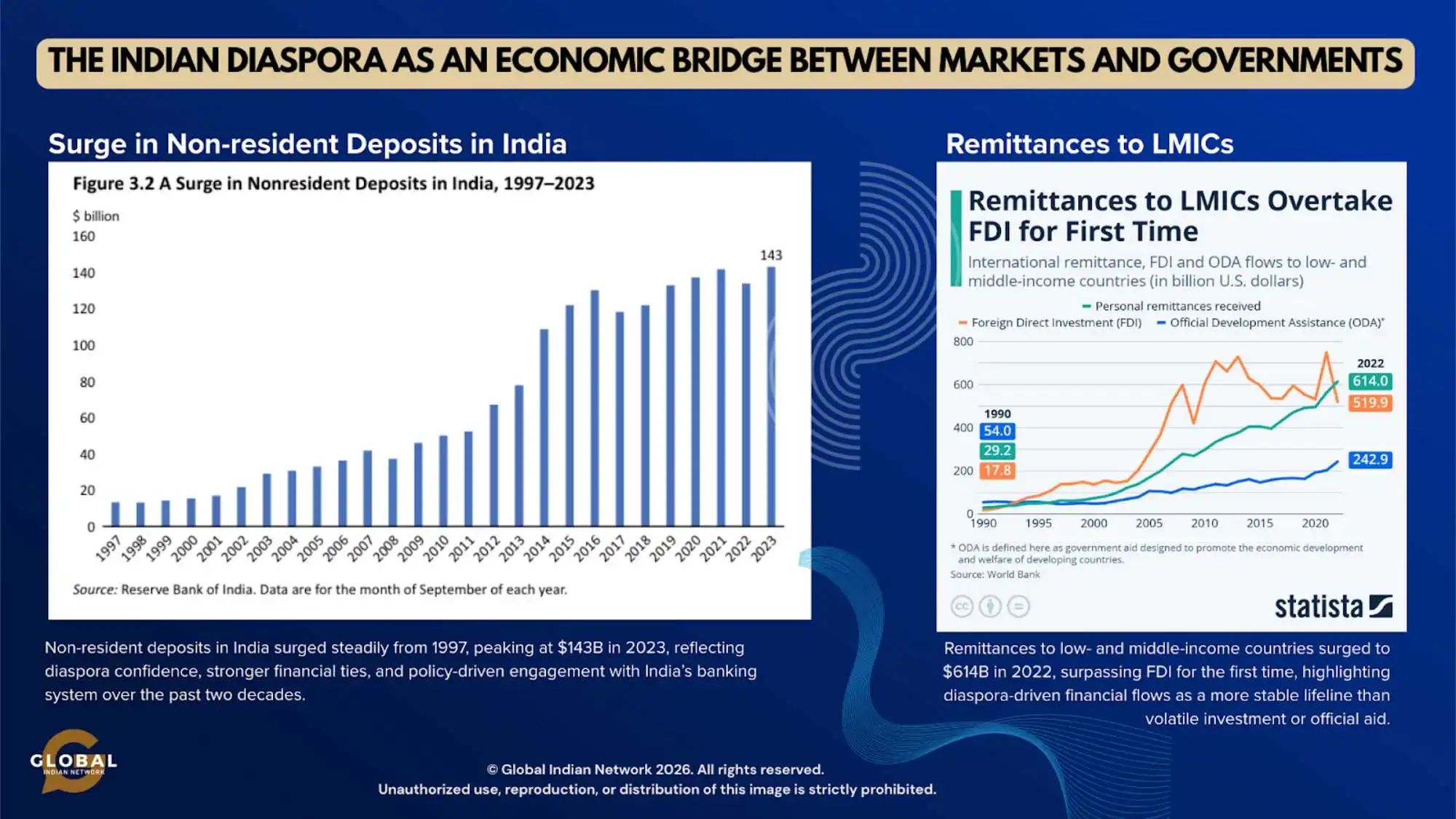

Remittances as Economic Lifeline

Surpassing FDI in both stability and scale, India’s record $135.46 billion in remittances (FY 2024-25) now accounts for nearly half of the nation’s trade deficit. Representing over 3% of the national GDP, this capital from the US, UK, and Gulf hubs is essential for funding imports and supporting household spending. This ‘diaspora dividend’ serves as a primary hedge against global market volatility and currency fluctuations.

Investments and FDI Flows

The diaspora is a critical source of ‘patient capital’ for India. Currently accounting for 35% of FDI, NRIs are increasingly moving beyond traditional savings into sophisticated investment vehicles. From the $10 billion recently funneled into dedicated NRI schemes to the high-impact investments of global leaders like ArcelorMittal’s Lakshmi Mittal, this community is fueling everything from foundational manufacturing to the modern startup ecosystem.

The diaspora’s role in transnational entrepreneurship serves as a vital ‘cultural bridge,’ streamlining bilateral trade by navigating the nuances of global and domestic markets. This is most evident in the UAE, where the long-standing contributions of the Indian community to national infrastructure laid the diplomatic and economic groundwork for the landmark 2022 Comprehensive Economic Partnership Agreement (CEPA).

Bridging Markets Through Trade and Networks

Diaspora networks are pivotal to the success of India’s international commerce, underpinning the $128 billion trade relationship with the US and driving significant flows within the EU. In South Africa, organizations like the India Business Forum (IBF) utilize the Africa-India Growth Corridor (AAGC) framework to catalyze job creation and technology transfer. These “circuit enterprises” leverage their unique bicultural intelligence to reduce market-entry barriers, facilitating the seamless movement of capital, goods, and human talent.

The prominence of Indian-origin CEOs at the helm of global giants like Alphabet, Microsoft, and Starbucks has redefined India’s business profile on the world stage. Beyond brand equity, these leaders facilitate critical bilateral synergies, particularly in high-stakes sectors like defense – through initiatives such as iDEX (Innovations for Defence Excellence)-and the burgeoning global startup ecosystem.

Government and Diplomatic Advocacy

The diaspora serves as a pivotal diplomatic catalyst, directly influencing high-level policy shifts. The US-India Business Council (USIBC) coalitions offered a striking example, rallying community support to lobby and finance advocacy that paved the way for the historic US-India Civil Nuclear Deal. Similarly, the diaspora in the UAE has been instrumental in securing strategic trade and security partnerships, while the community in South Africa plays a key role in strengthening G20 ties and championing the voice of the Global South.

Pravasi Bharatiya Divas 2025 serves as the primary bridge for the “Viksit Bharat” vision, mobilizing the global Indian community to fuel national missions like Digital India and Skill India. Beyond honoring achievements, the convention acts as a policy incubator, integrating diaspora expertise into domestic governance. Strategically, this unified global front amplifies India’s diplomatic push for a permanent seat on the UN Security Council, turning cultural success into geopolitical leverage.

Philanthropy and Knowledge Transfer

The diaspora has shifted from traditional charity to strategic “impact investing” in India’s social fabric. With total funding soaring to $300 billion, the global network is shifting its attention toward creating institutions that can endure and thrive sustainably. High-value endowments to the IITs demonstrate a commitment to R&D, while family-led philanthropic offices are now the primary backers for scaling social startups that tackle public health and education at the grassroots level.

Knowledge circuitry is transforming India into a global tech hub. Returnees from Silicon Valley and European tech corridors are launching ventures that bridge the gap between local talent and global R&D requirements. By leveraging PBD sessions as a strategic forum, government and diaspora leaders are co-creating frameworks for climate resilience and specialized labour migration, thereby ensuring that the flow of human capital remains two-way.

Case Studies: Real-World Bridges

US Lobbying for Nuclear Deal: Indian-Americans raised funds, hired firms like Patton Boggs, and coordinated with USIBC to pass the deal, creating jobs and ending “nuclear apartheid.”

South Africa Economic Ties: Diaspora entrepreneurs via IBF promote India-SA investments, leveraging cultural centers for policy advocacy.

UAE CEPA Acceleration: 3 million Indian workers fueled the UAE‘s growth, paving the way for fast-tracked trade pacts.

UK FTA Influence: Diaspora input shaped trade policies amid Brexit

Case Studies of Indian Diaspora CEOs

Indian-origin CEOs serve as a vital “soft power” asset, leveraging their global stature to advocate for deeper bilateral economic integration. Through organized bodies like the US-India Business Council (USIBC) and high-level CEO forums, they have been instrumental in navigating complex trade negotiations, including the recently announced “Mission 500” aiming for $500 billion in US-India trade by 2030. Their presence at exclusive summits, such as the 2026 Trump-CEO reception in Davos, enables them to directly address tariff barriers and digital trade frameworks, turning corporate success into a strategic advantage for India’s global standing.

| Milestone | Source / Entity | Impact |

| White House State Dinner | The Economic Times / White House | Verified tech industry support for the iCET framework. |

| $17.5B AI Investment | Microsoft / ET Online (Dec 2025) | Established India as a global hyperscale hub with 6 data regions. |

| TRUST Initiative | Principal Scientific Adviser (Feb 2025) | Evolved iCET into TRUST, expanding to critical minerals and biotech. |

| Budget 2026 Advocacy | USISPF / Mukesh Aghi (Feb 2026) | Secured “Ease of Doing Business” reforms for the cloud and manufacturing sectors. |

US-India Strategic Partnership

Sundar Pichai (Alphabet/Google CEO) and Satya Nadella (Microsoft CEO) attended PM Modi’s 2023 White House state dinner, signaling tech sector support for deepening US-India relations amid iCET and trade talks. Pichai emphasized shared democratic values and tech collaboration, boosting investor confidence for bilateral deals like semiconductors and AI. Nadella described himself as a “product of the India-US bond,” advocating for AI investments during 2025 Republic Day events and Modi meetings, aligning with USISPF efforts in which CEOs poll on manufacturing shifts to India despite tariffs.

Government Initiatives and Future Role

Pravasi Bharatiya Samman Awards and OCI cards incentivize engagement. FICCI, CII target diaspora for FDI beyond remittances. Toward Viksit Bharat 2047, focus shifts to skills, renewables, and advocacy.

Challenges such as low-skilled vulnerabilities persist, but opportunities in AI and green technology loom large. By 2047, India’s diaspora, if systematically integrated into financial and policy architecture, could represent trillions of dollars in cumulative capital flows.

Challenges Faced by the Diaspora

Strategic hurdles-such as fragmented legal frameworks and tax residency complexities-continue to impede seamless diaspora capital flows. Despite Budget 2026 providing relief through a twofold increase in PIS limits to 10%, remittances still outpace direct investment participation. The disconnect persists as investors navigate market volatility and the “compliance cliff” of shifting tax statuses, which often overshadow recent procedural wins like the abolition of the Angel Tax and easier property TDS rules.

Regulatory and Compliance Barriers

Despite Budget 2026 doubling individual PIS limits to 10% (24% aggregate), NRIs still navigate a high-friction landscape. Strict FEMA boundaries and the rigid separation of repatriation and non-repatriation accounts create administrative bottlenecks, often compounded by KYC inconsistencies. These bureaucratic delays frequently drive investors toward more complex FPI routes or offshore Gift City structures to bypass domestic hurdles. Moreover, ambiguities in cross-border inheritance, property repatriation, and share-gifting rules persist as major barriers to seamless capital integration.

Taxation Complexities

With dividends taxed at 20% and short-term capital gains ranging from 15–30%, residency ambiguities further subject NRIs to double taxation, absent meaningful DTAA relief. Global mergers incur indirect transfer taxes, and slow TDS refunds erode high-net-worth returns, while NRIs miss resident-like tax incentives for AIFs and infrastructure long-term holdings.

Currency and Repatriation Risks

Rupee volatility and RBI repatriation caps (e.g., $1 million/year under the LRS) expose NRI investors to foreign exchange losses amid FPI outflows ($23 billion in 2025-26). Rising hedging costs and locked non-repatriable funds further deter risk-averse diaspora participation.

Sectoral and Market Constraints

Foreign ownership caps persist in defense (49%), banking (74%), and insurance (74%), restricting diaspora stakes despite PLI incentives. Low Gift City awareness, high AIF compliance costs, and mid-cap illiquidity with premium valuations favor institutional FPIs over individual NRIs.

Geopolitical and Perception Issues

Host-country regulations (e.g., UAE remittance scrutiny) and India’s perceived policy unpredictability (e.g., retrospective taxes) breed caution. Diaspora critiques Budget 2026 for ignoring job creation and inclusive growth, signaling trust gaps. Brain drain reciprocity-talent outflow without reverse investment incentives further hampers flows.

Recent Budget 2026 reforms (PIS expansion, AIF tweaks) address some issues, but full parity with residents and faster digitization are needed for the $1 trillion potential unlocking by 2047.

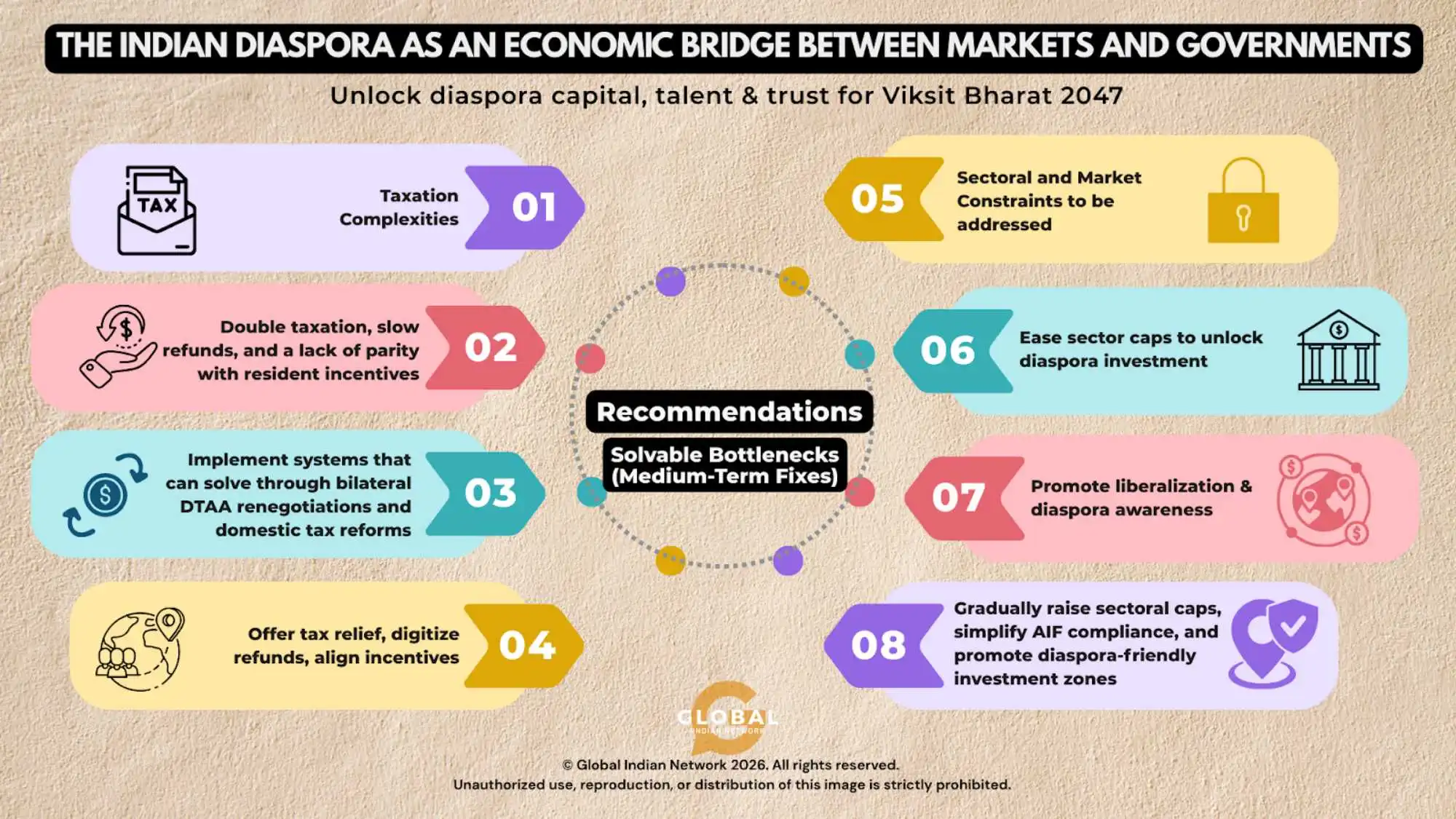

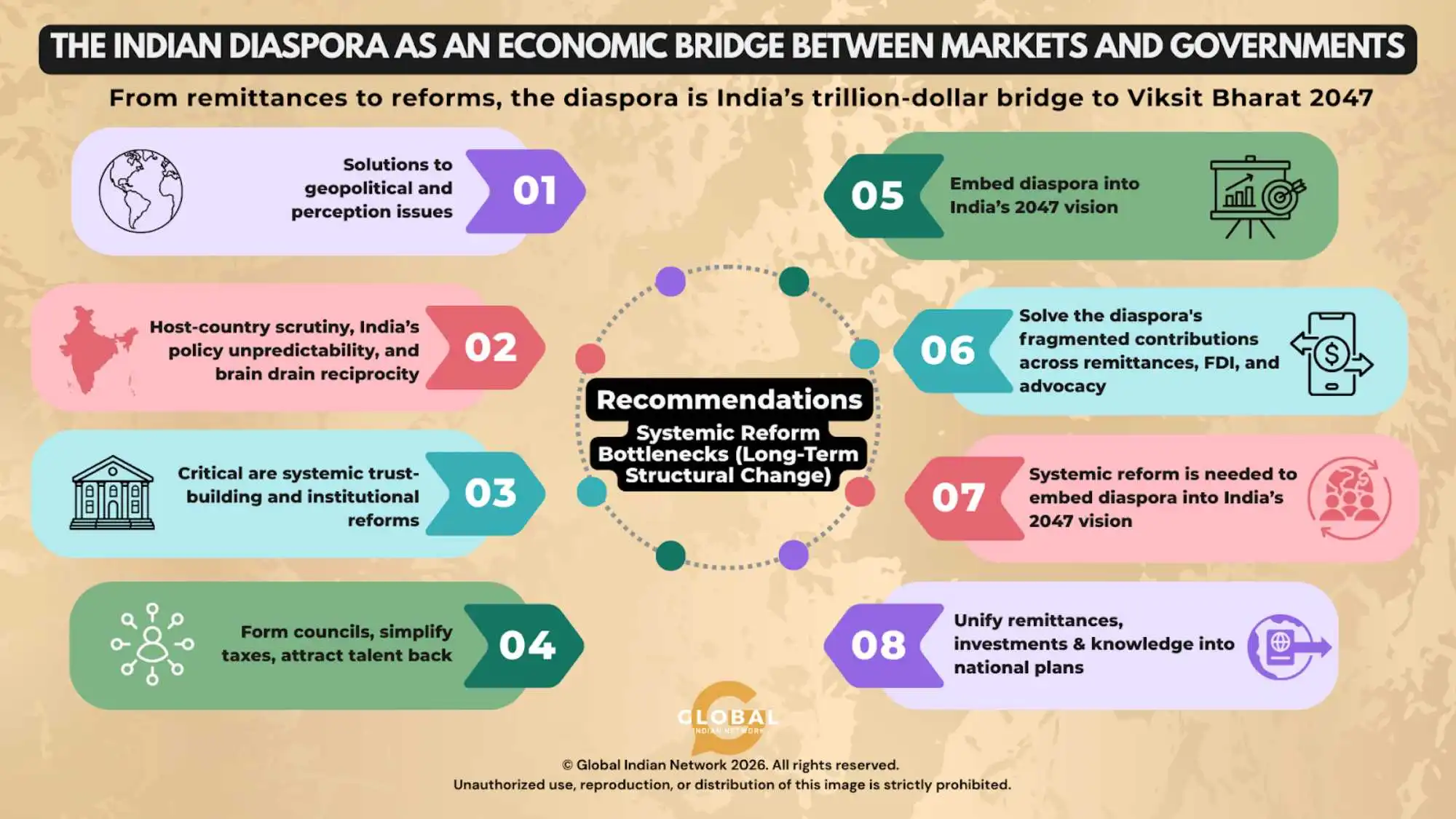

Overview: Recommendations

This section begins by emphasizing a tiered approach to diaspora engagement. Urgent fixes such as easing compliance barriers and addressing currency risks must be prioritized to unlock immediate capital flows and strengthen investor confidence. Medium-term reforms should focus on solvable issues such as tax complexity and sectoral ownership caps, thereby creating a more enabling environment that fosters trust and participation. Finally, systemic reforms aimed at improving policy consistency, deepening integration, and reshaping global perceptions are essential to fully harness the diaspora’s trillion‑dollar potential and align their contributions with India’s 2047 vision.

Urgent Bottlenecks (Immediate Action Required)

- Regulatory and Compliance Barriers

- FEMA restrictions, KYC delays, and fragmented account structures create friction.

- Address regulations that directly deter capital inflows and erode trust.

- Fast-track digitization of compliance, unify repatriation rules, and streamline NRI account structures.

- Currency and Repatriation Risks

- Rupee volatility, RBI caps, and rising hedging costs discourage participation.

- Focus on regulations that affect liquidity and confidence in real time.

- Expand hedging instruments, relax repatriation caps, and incentivize diaspora forex participation.

Solvable Bottlenecks (Medium-Term Fixes)

- Taxation Complexities

- Double taxation, slow refunds, and a lack of parity with resident incentives.

- Work on systems that hinder bilateral DTAA renegotiations and domestic tax reforms.

- Introduce diaspora-specific tax relief, digitize refund processes, and align incentives with resident investors.

- Sectoral and Market Constraints

- Foreign ownership caps in defense, banking, and insurance limit diaspora stakes.

- Implement systems that can solve targeted liberalization and awareness campaigns (e.g., Gift City).

- Gradually raise sectoral caps, simplify AIF compliance, and promote diaspora-friendly investment zones.

Systemic Reform Bottlenecks (Long-Term Structural Change)

- Solutions to geopolitical and perception issues

- Host-country scrutiny, India’s policy unpredictability, and brain drain reciprocity.

- Critical are systemic trust-building and institutional reforms.

- Establish diaspora councils for policy dialogue, ensure consistency in taxation/regulation, and incentivize reverse talent flows.

- Integration into National Strategy

- Diaspora contributions remain fragmented across remittances, FDI, and advocacy.

- Systemic reform is needed to embed diaspora into India’s 2047 vision.

- Develop a unified diaspora economic framework that links remittances, investments, and knowledge transfer to national development plans.

Conclusion

India’s global diaspora has already proven itself as a lifeline through remittances, a catalyst for investment, and a bridge for diplomacy. Yet its full potential remains constrained by regulatory bottlenecks, taxation hurdles, and perception gaps. Unlocking this trillion‑dollar force requires a layered strategy: urgent compliance and currency reforms to release immediate flows, medium‑term fixes to taxation and sectoral caps to build confidence, and systemic reforms to embed diaspora capital and knowledge into India’s long‑term development architecture. By treating the diaspora not as an auxiliary but as a co‑architect of Viksit Bharat 2047, India can transform global networks into enduring engines of growth, resilience, and influence.

The Global Indian Network plays a catalytic role in amplifying diaspora voices, curating data-driven insights, and shaping narratives that connect communities with policymakers. By serving as both a knowledge hub and an advocacy platform, it ensures that diaspora contributions are strategically aligned with India’s economic and diplomatic priorities.

Be part of our journey to success.